JEANNE KENTCH

Assessor

To Mohave County Taxpayers,

As the Assessor I am mandated by law to assess pr operty based upon its marketable value.

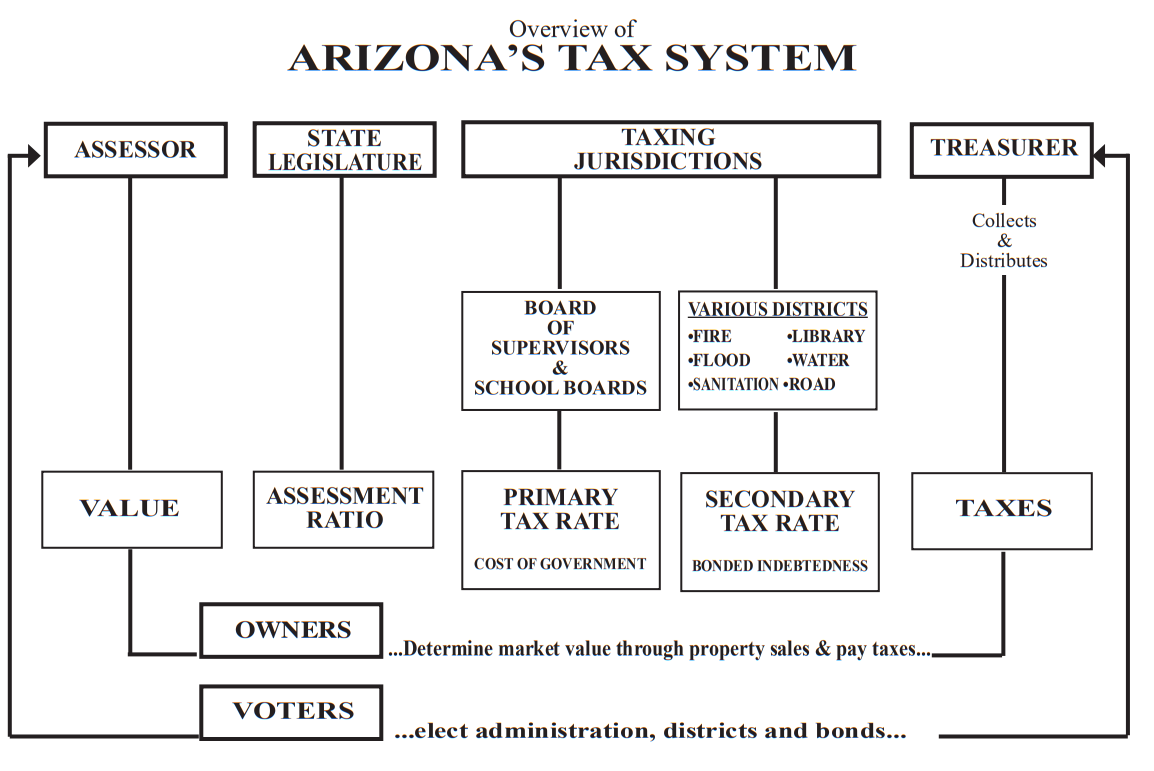

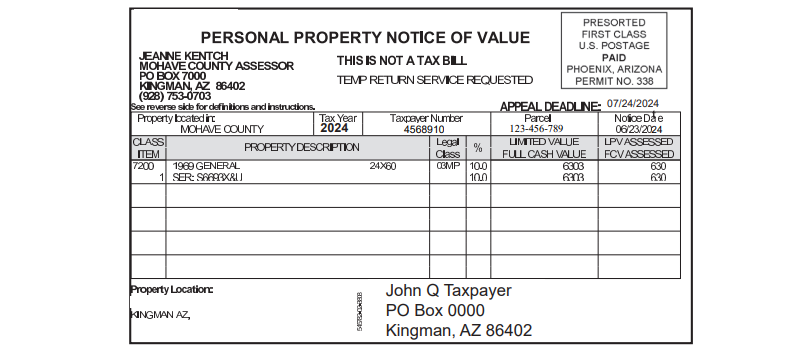

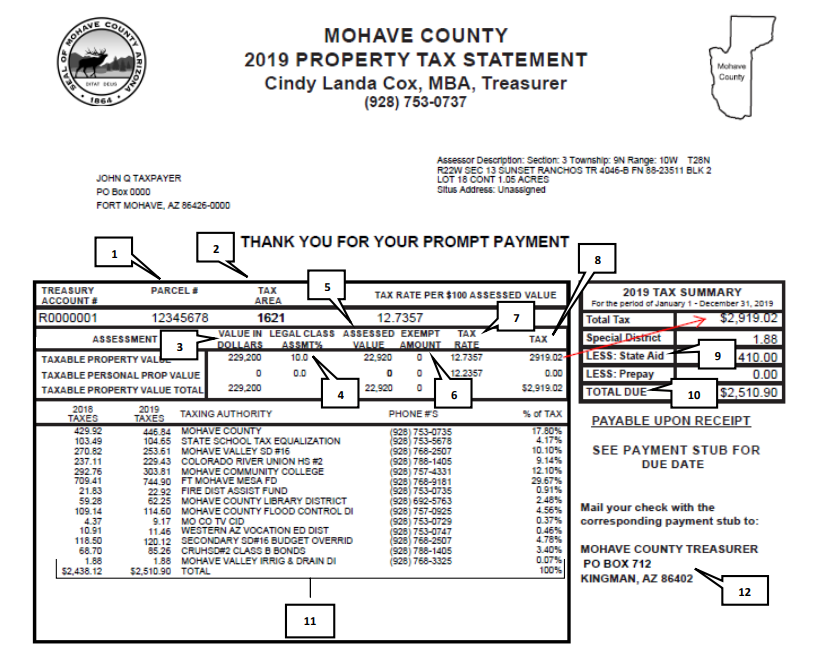

The Assessor is responsible for your assessed property value and NOT responsible for your property TAX RATE. Your tax bill includes different tax rates from multiple taxing authorities such as cities, counties, school districts, fire districts, water districts and more. These taxing authorities use different rates multiplied by your assessed value creating your tax bill.

The best way to keep your tax bill down is to pay attention to the TAX RATES you will be charged by the aforementioned authorities and/or districts. Taxing jurisdictions such as these districts may set budgets that require higher or lower tax rates. Keeping yourself informed is the best approach to understanding your taxes due.

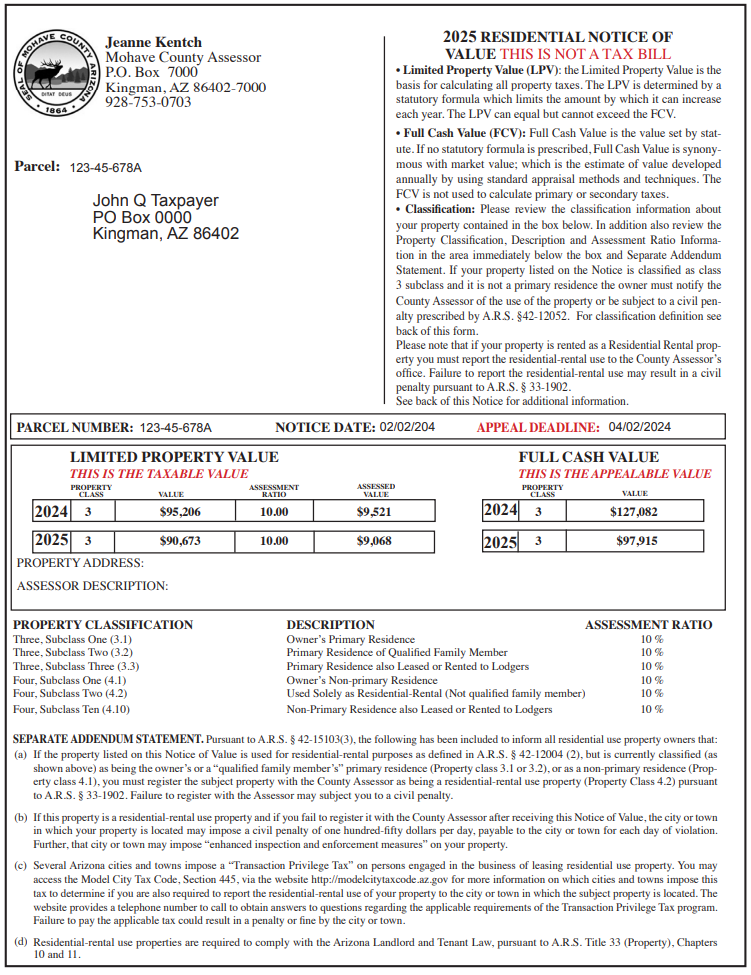

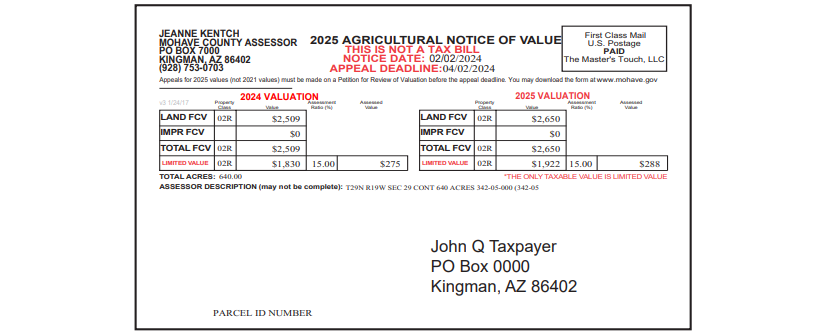

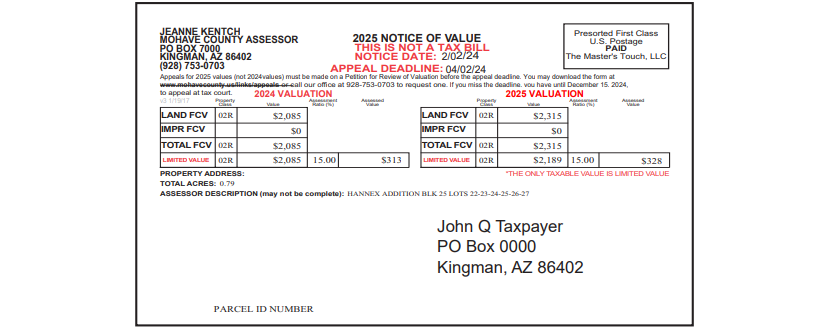

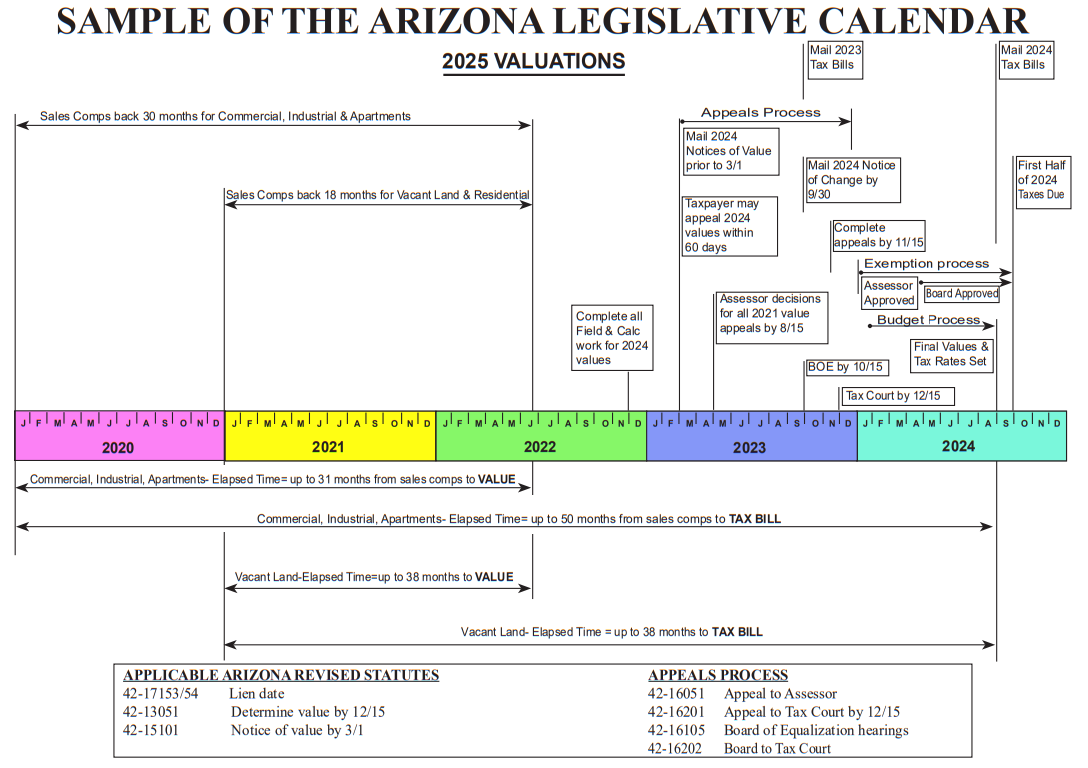

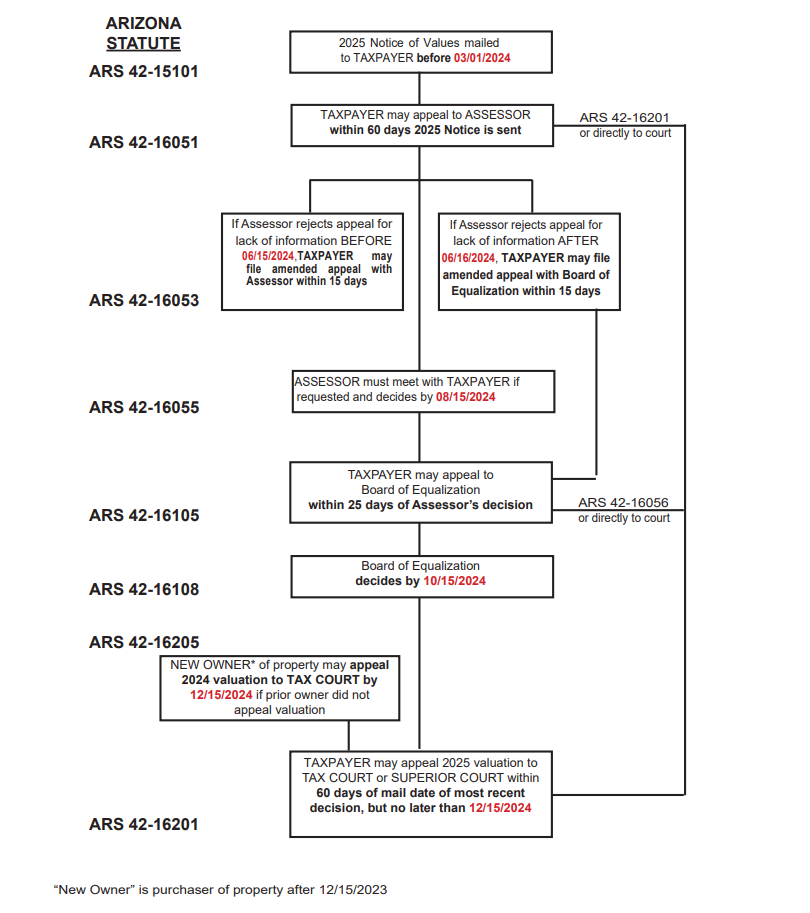

If however you feel the FULL CASH VALUE of your property is incorrect you have the right to appeal. Appeals are accepted within 60 days of when your Annual Notice of Value is mailed. Notice of Values are mailed out no later than March 1st of each year.

If, after your appeal, you still feel the FULL CASH VALUE is incorrect you can request a hearing with the Board of Equalization (BOE) within 25 days of the Assessor’s decision regard-ing your appeal. Mohave County has yearly hearings at the Board of Supervisors auditorium, in Kingman to assist owners in providing a fair full cash value with a hearing officer. If you still feel the FULL CASH VALUE is incorrect you have the right to file for appeal at the Arizona Tax Court by December 15 of that year (or within 60 days of the Assessors decision).

The Mohave County Assessor’s department is diligent in their property appraisals, We are proud of our fair and equitable process in assessing your property values.

I am very happy to serve the citizens of Mohave County as your elected Assessor.

If you have any questions please do not hesitate to contact our office or me for assistance.

Jeanne Kentch

Mohave County Assessor