Understanding Arizona Property Taxes

To Mohave County Taxpayers,

As the Assessor I am mandated by law to assess property based upon its marketable value.

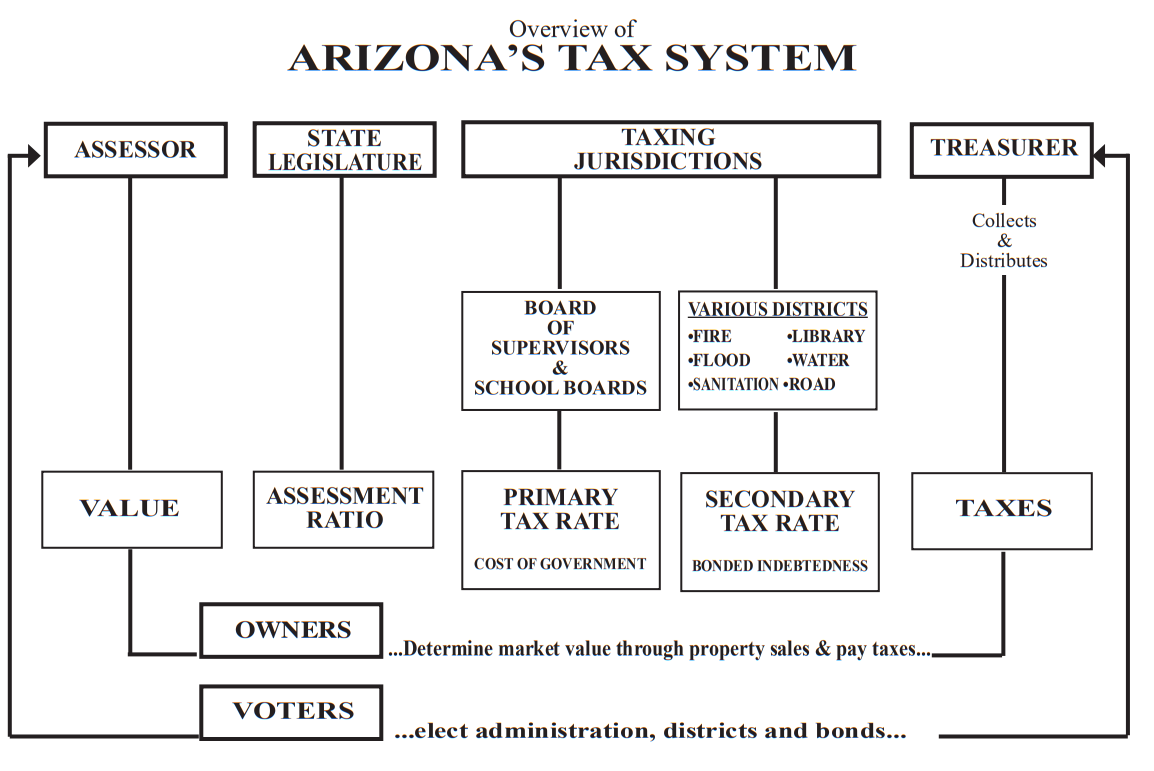

The Assessor is responsible for your assessed property value and NOT responsible for your property TAX RATE. Your tax bill includes different tax rates from multiple taxing authorities such as cities, counties, school districts, fire districts, water districts and more. These taxing authorities use different rates multiplied by your assessed value creating your tax bill.

The best way to keep your tax bill down is to pay attention to the TAX RATES you will be charged by the aforementioned authorities and/or districts. Taxing jurisdictions such as these districts may set budgets that require higher or lower tax rates. Keeping yourself informed is the best approach to understanding your taxes due.

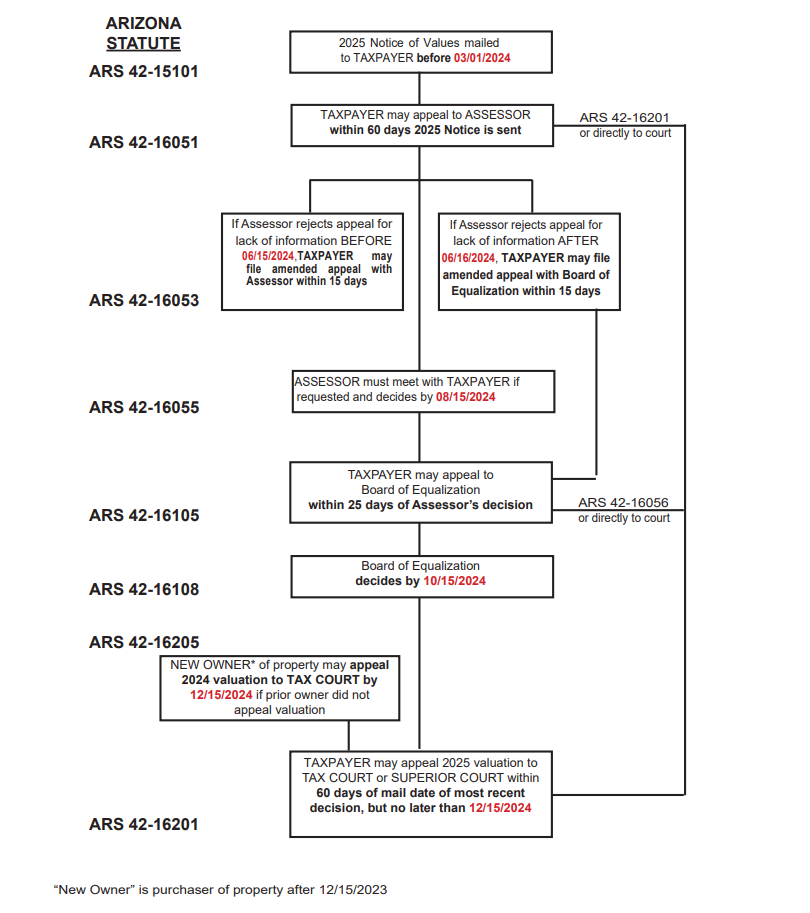

If however you feel the FULL CASH VALUE of your property is incorrect you have the right to appeal. Appeals are accepted within 60 days of when your Annual Notice of Value is mailed. Notice of Values are mailed out no later than March 1st of each year.

If, after your appeal, you still feel the FULL CASH VALUE is incorrect you can request a hearing with the Board of Equalization (BOE) within 25 days of the Assessor’s decision regard-ing your appeal. Mohave County has yearly hearings at the Board of Supervisors auditorium, in Kingman to assist owners in providing a fair full cash value with a hearing officer. If you still feel the FULL CASH VALUE is incorrect you have the right to file for appeal at the Arizona Tax Court by December 15 of that year (or within 60 days of the Assessors decision).

The Mohave County Assessor’s department is diligent in their property appraisals, We are proud of our fair and equitable process in assessing your property values.

I am very happy to serve the citizens of Mohave County as your elected Assessor. If you have any questions please do not hesitate to contact our office or me for assistance.

Jeanne Kentch Mohave

County Assessor

PROPERTY VALUATION

Between January and March of each year, the Assessor’s Office is required by Arizona State Statute to notify property owners of their Full Cash Value (defined as market value) for the following tax year. In order to value appropriately, the Assessor’s Office collects sales data in the same sales market area in which a property is located.

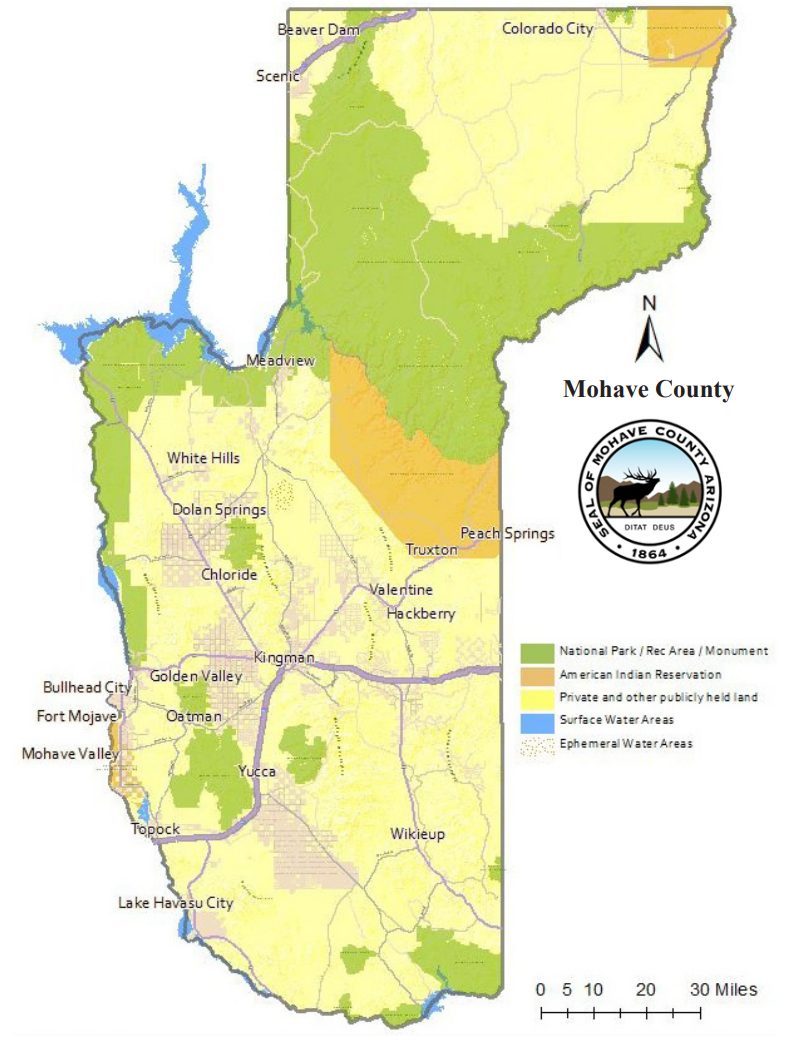

All Mohave County land values (vacant, residential and commercial) are valued based on comparable sales and/or income. The land sales are adjusted for location, size, topography, etc.

Residential improvement values are primarily based on regression analysis of qualified “arms length” market sales and are adjusted for location, size, age, quality of construction, additional improvements, etc.

Commercial improvement values are based on a Marshall & Swift cost calculation and adjusted for location, size, quality of construction, depreciation, etc.

The improvement values noted above are added to the land value to determine the final Full Cash Value (FCV)

Elements such as location, view, size, quality and condition are compared and factored in a mass appraisal mathematical model to arrive at each parcel’s Full Cash Value. The market is driven by actual sales that occurred in a time frame established by the Arizona Department of Revenue. Increases and decreases of sales prices will impact the final valuation. As an example, 2024 valuations will be derived from qualified sales which occurred during the whole year of 2021and the first 6 months of 2022. Because we are valuing for tax purposes up to two years into the future, any increase or decrease in the market values today will be reflected in future valuation years. Additionally keep aware that the entire process is mandated by Arizona Statute and the Department of Revenue guidelines.

The primary taxing authorities (Mohave County, Cities and Mohave Community College are governed by Proposition 101 which requires them NOT to increase their levies more than 2% annually (not including new construction). Taxing authorities such as school districts, fire districts and other secondary taxing authorities are not regulated under Proposition 101.

For more information about tax rates, budgets and taxing authority contacts visit: Taxing Jurisdictions

PROPERTY VALUES AND TAXES IN ARIZONA

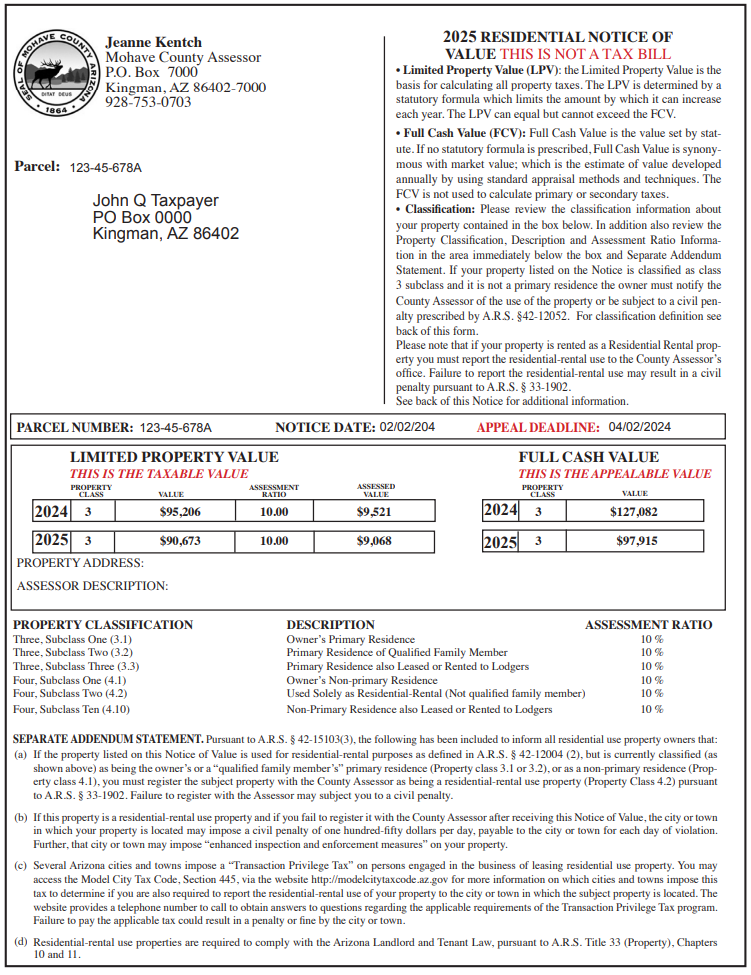

FULL CASH VALUE (FCV) - synonymous to “market” value.

LIMITED PROPERTY VALUE (LPV) - calculated according to statutory

formula and designed to reduce the effect of inflation on property taxes. This value cannot increase more than 5% each year nor can it ever exceed the FCV, unless there are changes to the property value such as adding a pool, garage or a change in use, the LPV may increase more than 5%.

Due to proposition 117 taxes are no longer calculated using Full Cash Value (FCV). The FCV is the only appealable value.

Arizona uses Primary and Secondary taxes.

PRIMARY TAXES - Used for basic maintenance and operations of the county, city or taxing district.

SECONDARY TAXES - Used for voter approved bonded debts of local jurisdiction, voter approved overrides of tax limits and taxes levied by voter approved special districts such as fire and sewer districts.

HOW PROPERTY IS VALUED

Full Cash Value (FCV) can be obtained by using 3 approaches to value; Sales Comparison, Replacement Cost and Income.

SALES COMPARISON – Compares property to other similar properties that have recently been sold. This approach is used mostly for homes and land.

REPLACEMENT COST NEW (Less Depreciation- RCNLD) – The cost it would be at today’s rate (material and labor) to replace the property with a similar structure. Once this total cost is calculated, a depreciation formula is subtracted from the amount. This approach is used mostly for homes that are not typical, remotely located, commercial buildings or mobile homes.

INCOME – This method is used mostly to value commercial properties. This approach requires operating information from the market, establishing what income the property can earn or even how much return can be expected on the investment.

...more about ASSESSOR FUNCTIONS

DISCOVERY

Once the Assessor’s office receives copies of building permits, we inspect all improvements. It is our policy to review each parcel at least every third year; this is called canvassing.

IDENTIFY

Every taxable structure is measured and graded. We document quality and type of construction materials throughout the entire structure. Vacant lots are reviewed as to comparable size, shape, topography, location and external influences.

LOCATE

Our cartography (mapping) department works full time keeping up with all of the recorded changes in property boundaries, new subdivisions, district boundaries and special district changes and creations.

LIST

Over 200 recorded documents that affect property (such as deeds) come through the Assessor’s from the Recorder’s office each day. Keeping up with ownership is a serious and time-consuming effort. Requests for mail address changes flow in continually from various sources. Owners must be aware that if they own property and do not receive a tax bill to contact the Assessor’s office for property ownership verification and the Treasurer’s office for a copy of the tax bill.

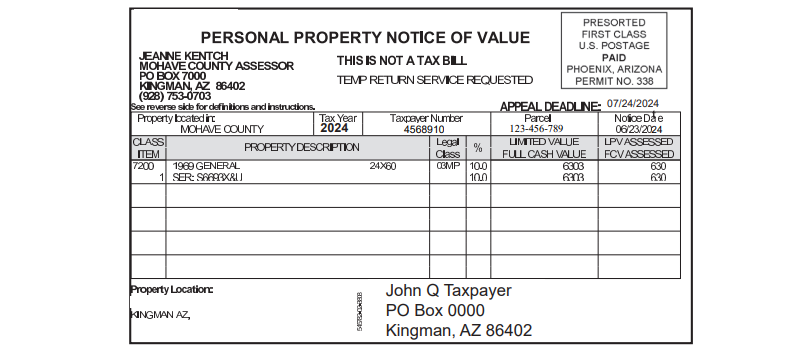

MANUFACTURED HOMES

In Mohave County, manufactured homes are valued by taking the original factory list price minus a depreciation factor based on age.

When a manufactured home is acquired, title is issued by the Arizona Department of Transportation.

OR

The owner can record an Affidavit of Affixture which will add the value of your manufactured home to your parcel of land. This process will require a surrender of the title to ADOT (MVD).

In Arizona manufactured homes can be valued 3 different ways:

Affixed to Real Property

- Record “Affidavit of Affixture”

- Land owner and manufactured home owner must be the same

- Manufactured home valued using manufacturer’s list price less depreciation

- Notice of Value for manufactured home and land sent once per year— tax bill includes both land and manufactured home

- Value shown under “Land, Bldgs, etc.” on real estate tax bill

- Pay property taxes in two installments (October and March) if tax bill is over $100

- Based on current tax rate

Attached Personal Property

- Title from ADOT

- Land owner and manufactured home owner must be the same

- Manufactured home valued using manufacturer’s list price less depreciation

- Notice of Value for manufactured home and land sent once per year— tax bill includes both land and manufactured home

- Value shown under “Personal Property” on real estate tax bill

- Pay property taxes in two installments (October and March) if tax bill is over $100

- Based on current tax rate

Personal Property

- Title from ADOT

- Land owner and manufactured home owner can be different.

- Manufactured home valued using manufacturer’s list price less depreciation.

- Notice of Value for manufactured home sent each year—real property tax bill sent separately.

- Value shown on Notice of Value and personal property tax bill.

- Pay property taxes in two installments (October and March) if tax bill is over $100

- Based on current tax rate

2024 PROPERTY CLASS SUMMARY

(11/16/2016)

|

PROPERTY CLASS |

DATA ENTRY PROPERTY CLASS |

VALID PROPERTY TYPE |

ASSMT RATIO |

PROPERTY CLASS CHARACTER |

DESCRIPTION (SHORT) |

|

1.1 |

0101 |

CVP |

.165 |

A |

PRODUCING MINES |

|

1.2 |

0102 |

LAP / R&P |

.165 |

P |

STANDING TIMBER |

|

1.3 |

0103 |

CVP |

.165 |

B |

GAS AND ELECTRIC |

|

1.4 |

0104 |

CVP |

.165 |

R |

AIRPORT FUEL DELIVERY |

|

1.5 |

0105 |

CVP |

.165 |

Q |

PRODUCING OIL AND GAS |

|

1.6 |

0106 |

CVP |

.165 |

T |

WATER UTILITY COMPANIES |

|

1.7 |

0107 |

CVP |

.165 |

U |

PIPELINES |

|

1.8 |

0108 |

LAP / R&P |

.165 |

V W Exempt |

SHOPPING CENTERS |

|

1.9 |

0109 |

LAP / R&P |

.165 |

0 1 Exempt |

GOLF COURSES |

|

1.10 |

0110 |

LAP / R&P |

.165 |

2 3 Exempt |

COMMERCIAL/MANUFACTURERS, ASSEMBLERS, FABRICATORS BOTH REAL & PERSONAL PROPERTY |

|

1.11 |

0111 |

CVP |

.165 |

4 5 Exempt |

TELECOMMUNICATIONS |

|

1.12 |

0112 |

LAP / R ONLY |

.165 |

C |

COMMERCIAL/INDUSTRIAL REAL PROPERTY AND IMPROVEMENTS NOT IN OTHER CLASSES |

|

1.13 |

0113 |

LAP / P ONLY |

.165 |

D X Exempt |

COMMERCIAL/INDUSTRIAL PERSONAL PROPERTY NOT IN OTHER CLASSES |

|

1.14 |

0114 |

CVP |

.165 |

! |

ELECTRIC COOPERATIVES |

|

2.C |

02C |

LAP / R ONLY |

.15 |

Z |

PROPERTY BURDENED BY CONSERVATION EASEMENTS |

|

2R.D |

02RD |

LAP / R ONLY |

.15 |

6 |

GOLF COURSES REAL PROPERTY NOT IN CLASS 1.9 |

|

2P.D |

02PD |

LAP / P ONLY |

.15 |

7 |

GOLF COURSES PERSONAL PROPERTY NOT IN CLASS 1.9 |

|

2.R |

02R |

CVP/LAP / R ONLY |

.15 |

E |

AG/VACANT LAND/NON-PROFIT–REAL PROPERTY AND IMPROVEMENTS NOT INCLUDED IN OTHER CLASSES |

|

2.P |

02P |

CVP/LAP / P ONLY |

.15 |

S Y Exempt |

AG/VACANT LAND/NON-PROFIT PERSONAL PROPERTY NOT INCLUDED IN OTHER CLASSES |

|

3 or 3.1 |

03 / 0301 |

LAP / R&P |

.10 |

F |

PRIMARY RESIDENCE |

|

3.2 |

0302 |

LAP / R&P |

.10 |

" |

PRIMARY RESIDENCE OF QUALIFIED FAMILY MEMBER |

|

3.3 |

0303 |

LAP / R&P |

.10 |

^ |

PRIMARY RESIDENCE ALSO LEASED OR RENTED TO LODGERS |

|

4.1 |

0401 |

LAP / R&P |

.10 |

, |

NON-PRIMARY/BANK OWNED/NOT IN OTHER CLASSES RESIDENTIAL (Please Note: Property Class character is a comma) |

|

4.2 |

0402 |

LAP / R&P |

.10 |

G |

RENTAL/LEASED RESIDENTIAL |

|

4.3 |

0403 |

LAP / R&P |

.10 |

) |

CHILD CARE FACILITIES |

|

4.4 |

0404 |

LAP / R&P |

.10 |

< |

NON-PROFIT RESIDENTIAL HOUSING FACILITIES FOR HANDICAPPED OR SENIORS |

|

4.5 |

0405 |

LAP / R&P |

.10 |

/ |

LICENSED RESIDENTIAL/NURSING CARE INSTITUTIONS FOR HANDICAPPED OR SENIORS |

|

4.6 |

0406 |

LAP / R&P |

.10 |

( |

BED AND BREAKFAST |

|

4.7 |

0407 |

LAP / R&P |

.10 |

> |

AGRICULTURAL HOUSING RESIDENCES NOT INCLUDED IN CLASS 3 |

|

4.8 |

0408 |

LAP / R ONLY |

.10 |

8 |

RESIDENTIAL COMMON AREAS VALUED PURSUANT TO ARS 4213403 |

|

4.9 |

0409 |

LAP / R&P |

.10 |

| |

TIMESHARES |

|

4.10 |

0410 |

LAP / R&P |

.10 |

@ |

NON-PRIMARY RESIDENTIAL LEASED OR RENTED TO LODGERS |

|

5 |

05 |

CVP |

.15 |

H FCV I LPV |

RAILROADS/PRIVATE CAR COMPANIES/FLIGHT PROPERTIES |

|

6.1 |

0601 |

LAP / R ONLY |

.05 |

J |

NON-COMMERCIAL HISTORIC |

|

6.2 |

0602 |

LAP / R&P |

.05 |

9 |

FOREIGN TRADE ZONES |

|

6.3 |

0603 |

LAP / R&P |

.05 |

+ |

MILITARY REUSE ZONES |

|

6.4 |

0604 |

CVP / LAP / R&P |

.05 |

* |

ENVIRONMENTAL TECHNOLOGY |

|

6.5 |

0605 |

LAP / R&P |

.05 |

# |

ENVIRONMENTAL REMEDIATION |

|

6.6 |

0606 |

LAP / R&P |

.05 |

? |

HEALTHY FORESTS |

|

6.7 |

0607 |

LAP / R&P |

.05 |

% |

BIODIESEL FUEL MANUFACTURING |

|

6.8 |

0608 |

LAP / R&P |

.05 |

: |

RENEWABLE ENERGY EQUIPMENT MANUFACTURING |

|

7.B |

07B |

LAP / R&P |

.18 |

K |

COMMERCIAL HISTORIC BASE VALUE |

|

7.H |

07H |

LAP / R&P |

.01 |

L |

COMMERCIAL HISTORIC RENOVATION VALUE |

|

8.B |

08B |

LAP / R&P |

.10 |

M |

RESIDENTIAL/COMMERCIAL HISTORIC BASE VALUE |

|

8.H |

08H |

LAP / R&P |

.01 |

N |

RESIDENTIAL/COMMERCIAL HISTORIC RENOVATION VALUE |

|

9 |

09 |

LAP / R&P |

.01 |

O |

CERTAIN IMPROVEMENTS ON GOVERNMENT PROPERTY |

LEGEND:

CVP = Centrally Valued Property

P or PP = Personal Property

LAP = Locally Assessed Property

FCV = Full Cash Value

R = Real Property

LPV = Limited Property Value

LEGAL CLASS AND ASSESSMENT RATIO

The effect of ASSESSMENT RATIO fluctuations.

Based on a hypothetical rate in a hypothetical tax area for the USE of a $199,500 property.

|

PROPERTY USE |

MARKET VALUE |

ASSESSMENT ASSESSED CLASS & RATIO VALUE |

TAX RATE (per $100) |

TOTAL TAX |

|

Residential |

$199,500 |

3 10% $15,500 |

[1] 9.076 |

$1,633.68 |

|

Residential |

$199,500 |

4 10% $15,500 |

10.2600 |

$1,846.80 |

|

Vacant Land |

$199,500 |

2 15% $23,250 |

10.260 |

$2,777.20 |

|

Commercial |

$199,500 |

1 16.5% $29,900 |

10.2600 |

$3,324.24 |

|

Mixed Use [2] |

$199,500 |

M 10.01-16.5% $15,500-$26,985 |

10.2600 |

$1,591-$2,768 |

NOTE: This data is for demonstration purposes only.

Our legislature changes classification and assessment ratios often.

Those changes can have a dramatic impact on taxes due.

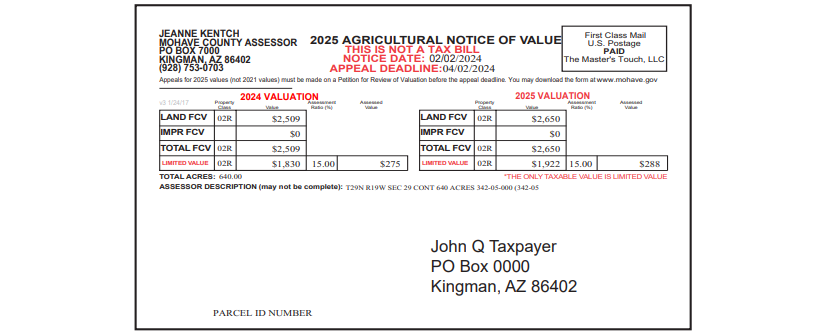

SAMPLE RESIDENTIAL NOTICE OF VALUE

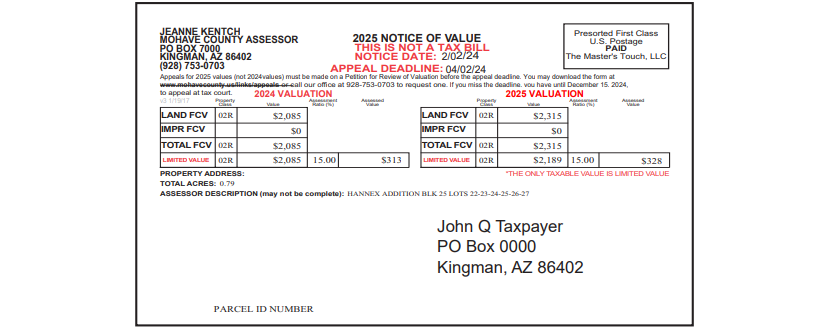

PERSONAL PROPERTY NOTICE OF VALUE

AGRICULTURAL NOTICE OF VALUE

VACANT LAND/COMMERCIAL/OTHER NOTICE OF VALUE

REAL PROPERTY APPEALS

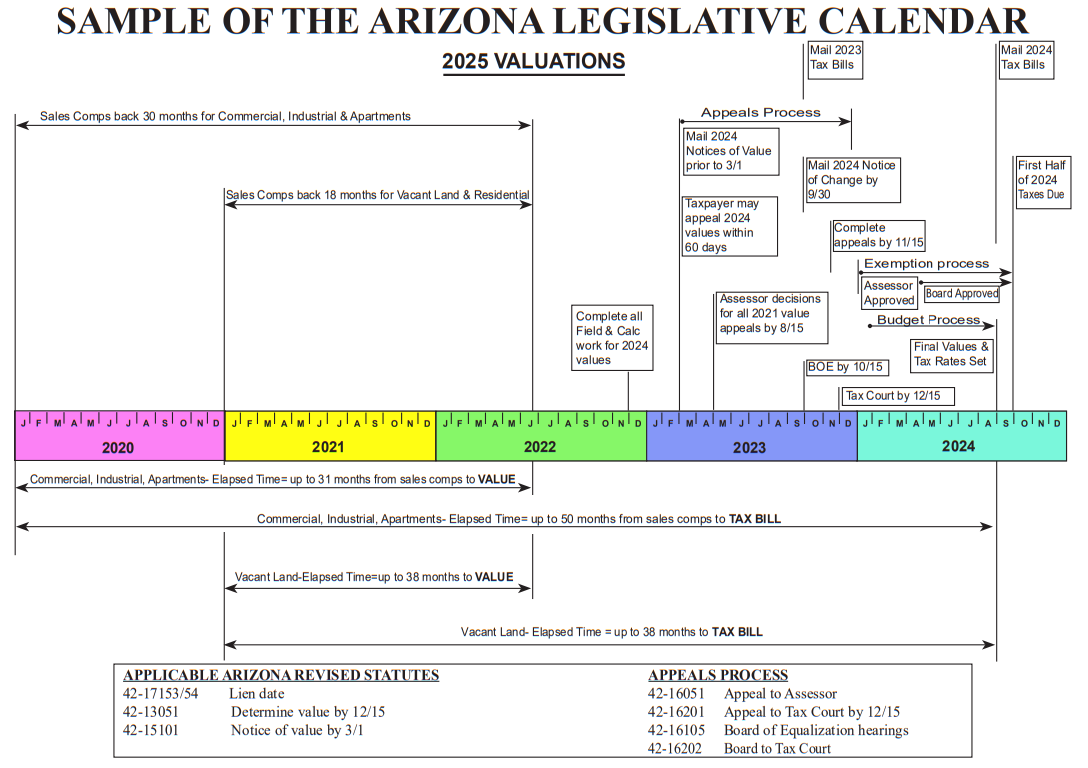

Events during Calendar Year 2024 for 2025 Valuations

Exemptions: Widows, Widowers, Disabled, and Disabled Veterans

1. Applicant must be a current resident of Arizona.

2. Value of all property owned in Arizona cannot exceed $26,969 Limited Property Value. The Assessed Value is derived by multiplying your Limited Property Value times the Assessment Ratio (assigned statutorily based on use of property).

For example, this means the Limited Property Value of a home can be no more than

$300,990. ($300,990 X 10% = $30,099)

The Limited Property Value of vacant land can be no more than $200,660.

($200,600 X 15% = $30,099).

If Applicant has more than one parcel, the total Assessed Values cannot exceed $30,099. For example: If the total Limited Assessed Value of both parcels is $35,000, then you are not eligible for an exemption. If the Limited Assessed Value of both parcels is $30,099 or less, then you may qualify for the exemption. However, the exemption will remove only $4,476 from the Limited Assessed Value. This exemption deduction amount can change yearly. The remaining amounts will be fully taxable.

3. Household income cannot exceed $37,297 or $44,745 with minor children. Does not include all typed of income (i.e. Social Security). Contact our office for a complete list.

4. Any exempt amount for which you qualify will be applied first to your real property.

5. A portion of any excess amount can be applied to your tags for your vehicle, travel trailer, etc.

6. The allowed amount of the exemption, $4,476 (2024 exempt amount), is subtracted from the final Limited Assessed Values of the qualified person's property. This may result in an estimated annual tax saving of $150 to $500.

EXEMPTION INFORMATION CONT.

ADDITIONAL QUALIFICATIONS FOR DISABILITY EXEMPTION

- Applicant must be over age 17.

-Certification of permanent disability by a Board Certified Practicing Medical person stating the applicant's inability to work for wages must be provided. The Certification letter may be obtained in any of our offices or online.

VETERANS DISABILITY EXEMPTION:

In 2022, Arizonans passed a proposition granting a new exemption for disabled Veterans. At the time of publication of this pamphlet, some of the specifics related to the exemption have not been made available to Arizona Assessors. However, the exemption will follow the format of other personal exemptions. It will grant a percentage of the annual exemption based on the percentage of disability as established by the Veteran's Administration.

ASSESSOR ADDRESS PROTECTION PROGRAM:

The Mohave County Assessor has recently implemented a program designed to reduce the potential fraud associated with mailing addresses. Our new program is called the Assessor Address Protection Program (AAPP).

This project began due to the many taxpayers the approached the Assessor asking for an additional layer of security for property ownership. We realized that fraud often begins with a change of mailing address. The Assessor's office wanted to ensure that the property owners are the only people who may change their mailing address. An unofficial change of mailing address could be fraudulent and result in the property owner not receiving tax notification, which could result in delinquency or ultimately a lien.

SENIOR PROPERTY VALUATION PROTECTION OPTION

An Arizona Constitution amendment provides for the “freezing” of the valuation of homes owned and occupied by seniors beginning in 2001. The requirements follow:

1. Every owner must fill out an application to apply. Applications are accepted from January 2nd through September 1st. At least one of the owners must be 65 years of age at the time the application is filed. A copy of proof of age must be submitted.

2. The property must be the primary residence of the taxpayer. For purposes of this application “Primary Residence” is defined as the residence which is occupied by the taxpayer for an aggregate of nine (9) months of the calendar year.

3. The owner must have resided in the primary residence for at least 2 years prior to applying for the option.

4. All owners’ combined total income from all sources, including non-taxable income, cannot exceed the specified amount in the amendment. This is $45,264 for a single owner and $56,580 for 2 or more owners.

5. If exterior alterations/additions are made to your property after the valuation lock has been approved, the value of the new alteration/addition will be added to the locked value.

If the owners meet all of these requirements and the application is approved, the limited property value of the primary residence will remain fixed for a 3-year period. To remain eligible, the owner is required to renew the option during the last 6 months of the 3-year period upon receipt of a notice of reapplication from the County Assessor. The freeze terminates and the property reverts to its current limited property value if the owner sells the home or otherwise becomes ineligible.

It is important to know that the VALUATION for the primary residence will be frozen as long as the owner remains eligible. TAXES will not be frozen and will continue to be levied at the same rate as all other properties in the taxing district.

PROPERTY TAX DEFERRAL

Legislation provides tax relief for residences of the elderly who qualify beginning in 1997. Filing can be done with the Assessor’s Office for deferral of taxes between January 1 - March 31.

To qualify for tax deferral the residence shall meet all the following requirements:

1. It must be the taxpayer’s primary residence.

2. It must not be income-producing.

3. It must not have a full cash value which exceeds $150,000.

4. It must not be subject to a mortgage less than 5 years old.

5. All property taxes for preceding years must be paid.

To qualify for tax deferral the individual must:

1. Be at least 70 years of age.

2. Own or be purchasing the residence under a recorded sale.

3. Have lived in home for 6 years or lived in Arizona for the preceding 10 years.

4. Not own or have beneficial interest in any other real property.

5. Meet all requirements (in case of a married couple, both spouses).

Property taxes deferred are not “forgiven.” The total amount of deferred tax, plus interest, and accrued cost is due and payable when: 1. The person who claimed the deferral dies without a surviving spouse who qualifies.

2. The property is transferred or conveyed.

3. The property is no longer the residence of the individual or their qualified spouse unless absence is due to illness.

In addition to the above requirements, the total taxable income of all persons living in the residence may not exceed ten thousand dollars ($10,000).

POST AND CERTIFY THE FINAL VALUES

Arizona Property Taxes are “Ad Valorem” taxes—which means “based on value”. Value is Arizona’s chosen means to fairly distribute our tax burden between property owners.

The Assessor’s job is to determine the value and use of each property. Depending upon the property location, the owner may share special district taxes with a few hundred neighbors and/or fire district taxes with a few hundred (or thousand) more, city taxes with several thousand; education districts are larger yet, —and finally, we all share Mohave County taxes equally.

Each year the assessed property values are totaled within each district and submitted to each “taxing authority” through the Tax Roll and to County Board of Supervisors.

TAX RATE

To set the TAX RATE, a taxing jurisdiction (county, city, school or fire district) must determine:

1. Its operating BUDGET for the fiscal year. This is usually the amount needed for operations and maintenance and new facility construction.

2. The LPV ASSESSED VALUE of all property within the jurisdiction, which is also known as the TAX BASE. (Your property is included here; the location determines which jurisdictions you support.)

3. OTHER REVENUE sources such as fees for services, other taxes and payments from state and federal governments.

BUDGET less OTHER REVENUE = LEVY (income needed)

LEVY / TAX BASE = TAX RATE (per $100 of value)

Your Property Value x Assessment Ratio x Tax Rate = YOUR TAXES

FREQUENTLY ASKED QUESTIONS

How do I change my mailing address?

Contact the Mohave County Assessor’s office at 928-753-0703.

How do I get a copy of my tax statement?

Go to: Tax Statements

How do I get a copy of my deed (or any recorded document)?

Contact the Mohave County Recorder’s office at 928-753-0701.

How do I get a map of my property?

Contact the Mohave County Assessor’s office at 928-753-0703.

How do I get a copy of an Arizona birth/death certificate?

Contact the Mohave County Department of Public Health at 928-753-0748.

How do I Homestead my property?

Contact the Mohave County Recorder’s office at 928-753-0701.

How do I register to vote in Arizona?

Contact Mohave County Recorder’s office – Voter Registration at 928-753-0767.

How do I register my rental property?

Contact Mohave County Assessor’s office at 928-753-0703.

How do I find out if my property is in a flood zone area?

Contact Mohave County Flood Division at 928-757-0925.

How do I find out if my road is maintained my Mohave County?

Contact Mohave County Road Division at 928-757-0905.

Who do I contact to get a permit for my property or find out what I can build?

If the property lies within a city limit (KNG,BHC,LHC,CC), please contact the city.

If the property lies within the unincorporated areas of the county, contact Mohave County Development Services at 928-757-0903.

Where is my septic located on my property?

If the property lies within a city limit (KNG,BHC,LHC,CC), please contact the city.

If the property lies within the unincorporated areas of the county, contact Mohave County Development Services at 928-757-0903.

How do I find out the zoning of my property?

If the property lies within a city limit (KNG,BHC,LHC,CC), please contact the city.

If the property lies within the unincorporated areas of the county, contact Mohave County Development Services at 928-757-0903.

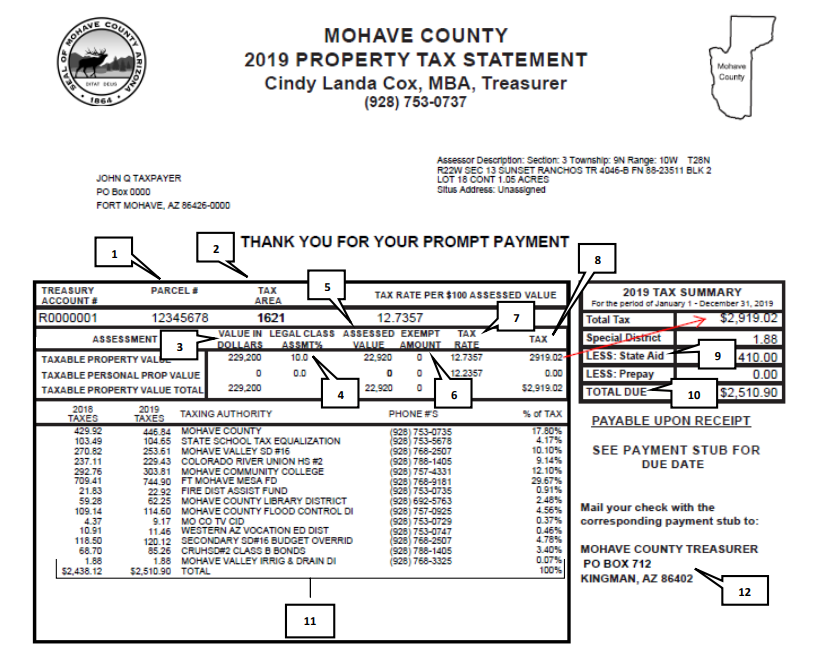

1. Parcel Number

This is the identifying number for your property. The number relates to our maps, which show your parcel. Refer to this for any communication with the Assessor or Treasurer.

2. Tax Area

This is the code for the geographic tax area where your property is located.

3. Limited Property Value

The value on which ALL TAXES are based. See page 5 for more on Limited Property Value.

4. Assessment Ratio

All taxable property in Arizona is classified according to its current use. Each class has a different assessment ratio. For example:

|

Property Use |

Class |

Ratio |

|

Commercial |

1 |

18% |

|

Vacant Land |

2 |

15% |

|

Residential |

3 |

10% |

5. Assessed Value

Value on which ALL TAXES are calculated, which is derived by multiplying the Limited Property Value (#3) times the Assessment Ratio % (#4).

6. Exemption

Amount of any exemption for which you qualify (widows/widowers or disabled).

7. Tax Rate

The TAX RATE percentage is applied to the Assessed Value to determine the amount of TAX.

8. Tax

The amount of tax derived by multiplying Assessed Value (#5) times Tax Rate % (#7). This is the tax amount before any prepay, state aid reductions or special district taxes.

9. State Aid to Education

This is a reduction for owner-occupied residential properties only.

10. Total Due

Total amount of taxes due.

11. Tax Authority Table

Displays contact information, amounts and percentages of taxes for each taxing authority within your tax area (#2). Taxing authorities may include: School Districts, Fire Districts, Mohave County and other special districts.

12. Mailing address for the Mohave County Treasurer

Mail your check with the corresponding payment stub to the address shown on your statement. Please do NOT send cash via mail.

REGISTERING RESIDENTIAL RENTALS

If you have residential rental property in Arizona used for residential rental purposes, as defined in Arizona Revised Statute (A.R.S.) 42-12004, you must register said property as a rental (Legal Class 4) with the County Assessor pursuant to A.R.S. 33-1902 of the Rental Residential Property law. Failure to do so may subject you to a penalty.

Residential Rental Properties are required to comply with the Landlord Tenant Act pursuant to Title 33, Chapters 10 and 11.

If you rent or lease your property to a qualifying family member, you are required to register it as rental property. A Qualified family member is:

1. The owner’s natural or adopted child or descendant of the owner’s child

2. The owner’s parent or an ancestor of the owner’s parent;

3. The owner’s stepchild or stepparent.

4. The owner’s child-in-law or parent-in-law;

5. The owner’s natural or adopted sibling.

6. You are not required to register the property as a rental if the rental period was three (3) months or less in the preceding twelve (12) months and not for more than three (3) months in the next twelve months:

A SPECIAL NOTE ON SHORT TERM RENTAL PROPERTIES:

Recent legislative changes at the state and local levels have focused on a more detailed tracking of properties made available for Short Term Rentals.

Your city may require a registration of property utilized this way. The

Assessor is mandated to correctly discover, list and value all Mohave County property. Short Term Rentals are no exception. If you make your property available for short term rental, complete a Residential Affidavit of A Property Class Change form is available online or at any of our offices.