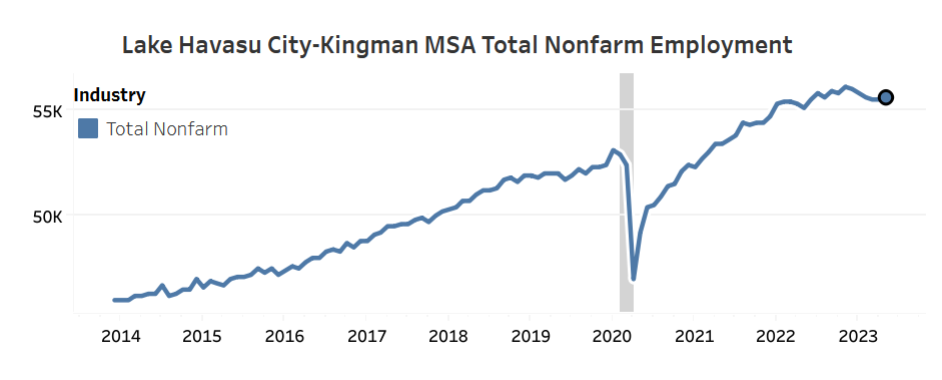

Existing Inventory

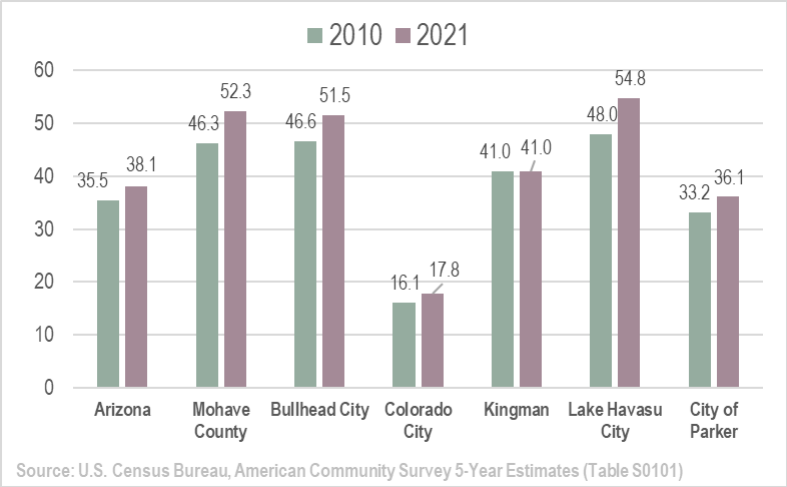

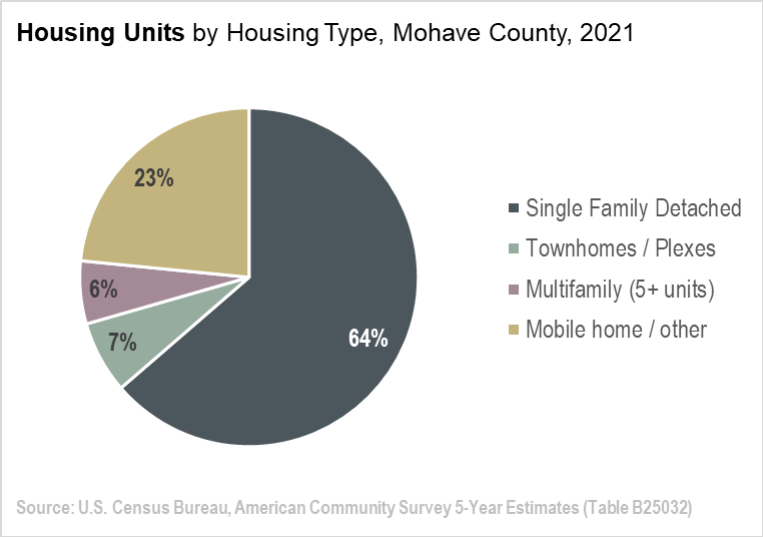

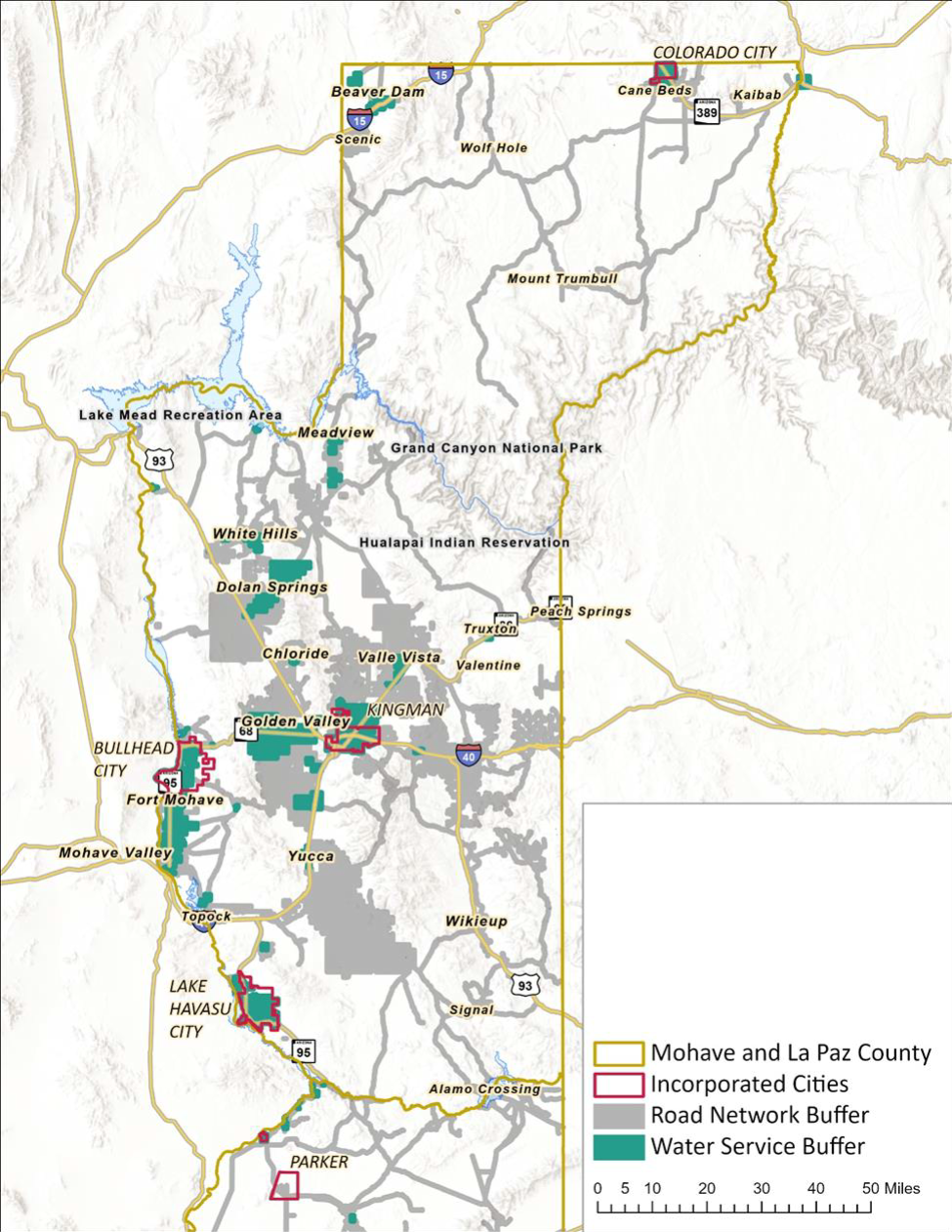

Local housing inventory and tenancy patterns shed light on housing conditions and demand preferences. In 2021, there were 116,893 housing units in Mohave County, of which 93,179 units were classified as occupied and 23,714 units were not occupied by permanent year-round households. It is estimated that many of these 23,714 housing units are used as seasonal second homes or investment properties.

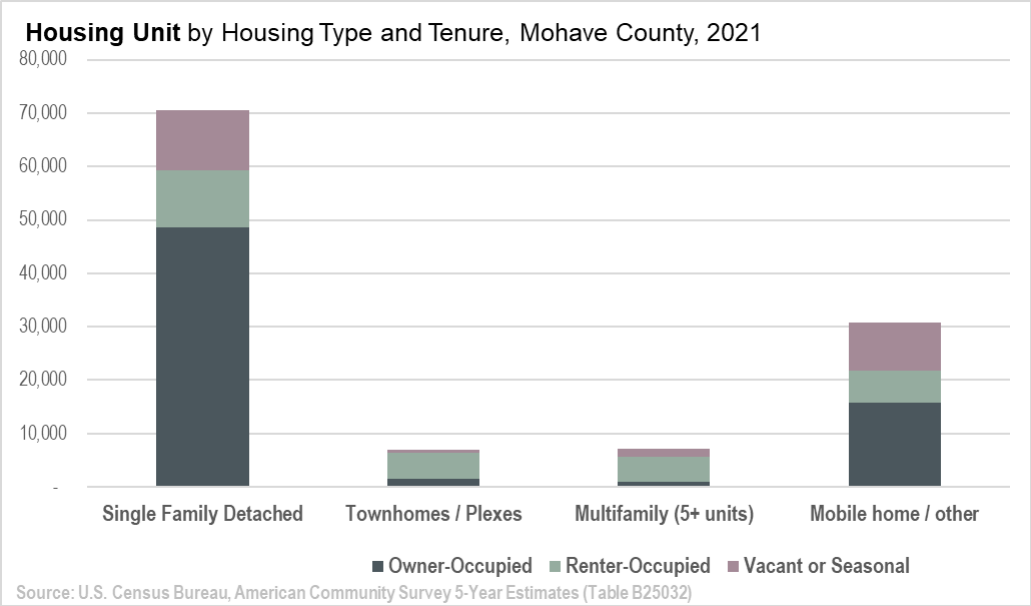

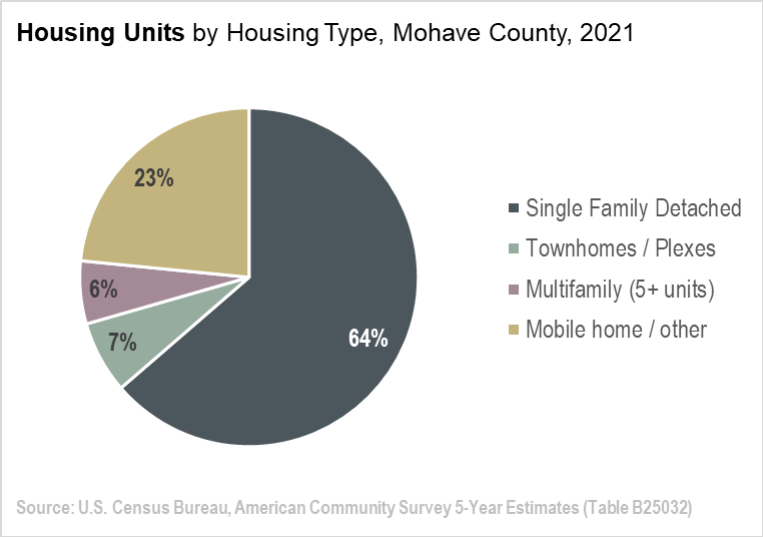

Like most counties in Arizona, single-family detached housing is the most prevalent housing type representing 64% of the housing stock. The remaining inventory in Mohave County includes mobile homes (23%), townhomes and plexes (7%), and multi-family (6%), as shown in Exhibit 15.

Exhibit 15: Existing Housing Mix

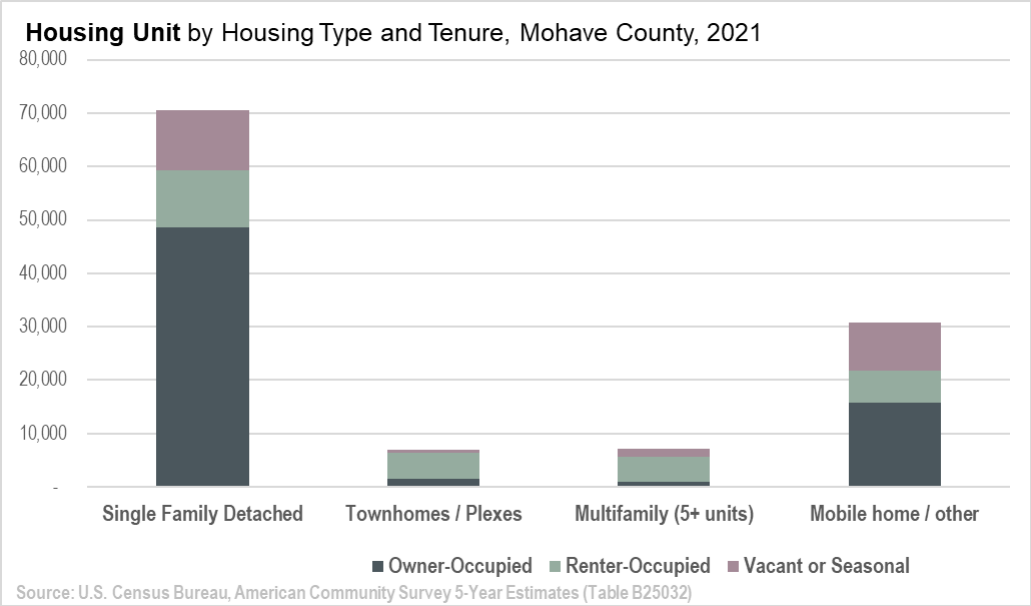

Owner-occupied housing units represent 58% of the housing inventory, while renter-occupied units account for 23% of the inventory, and vacant and seasonal units make up the remaining 19% (Exhibit 16).

Exhibit 16: Existing Housing Tenancy, 2021, Mohave County

The current overall housing vacancy rate in Mohave County is estimated at 1%. However, nearly one (1) in five (5) homes in Mohave County (19% of the entire housing inventory) are used as second homes, or seasonal housing, by out-of-county residents. The second home inventory represents 23,714 housing units in Mohave County.

While there is little data regarding short-term rentals in Mohave County, interviews with real estate professionals indicate that the short-term rental market (units rented on a daily, weekly, or monthly basis) is significant in waterfront communities, such as Lake Havasu City and Bullhead City, and is, also, increasing in Colorado City.

Officials from Lake Havasu City indicated that there are approximately 2,000 total short-term rentals units in the City, including 1,200 units that are registered and an estimated 800 rentals that are not registered, at this time. In Bullhead City there are 585 short-term rental units registered with the City, according to local officials.

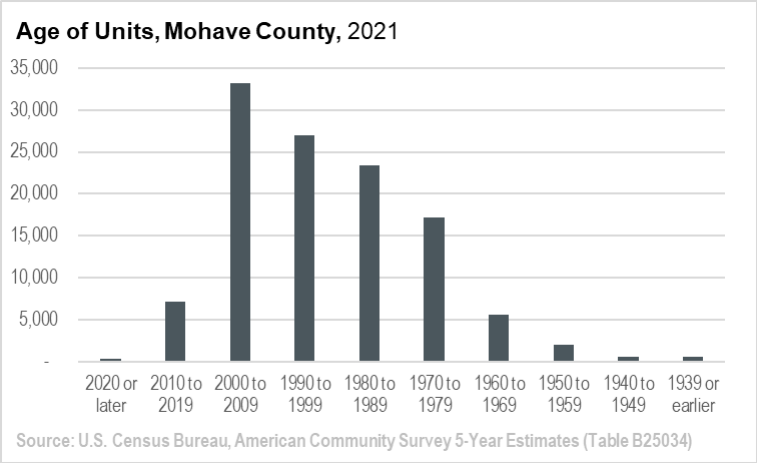

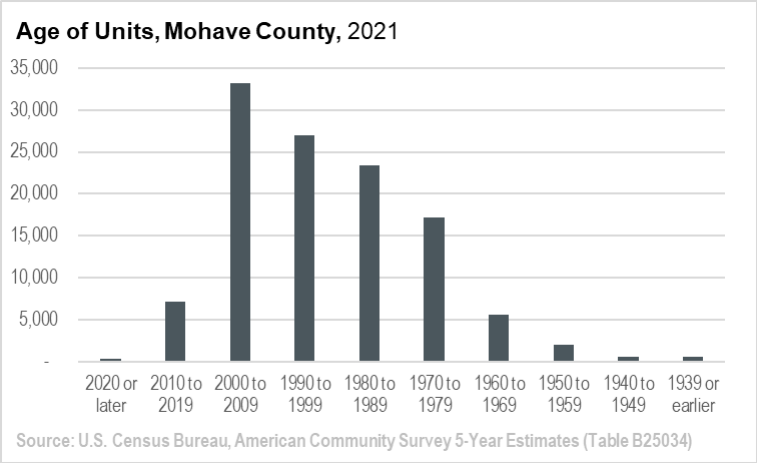

Exhibit 17 reflects housing units by year of construction. As of 2021, the median age of all housing units in Mohave County was 27 years (built in 1994). However, the median age for the rental housing inventory was slightly older at 30 years (built in 1991).

In comparison with statewide averages, the median age of owner-occupied housing in Mohave County was 26 years compared with 35 years for the state. The median age for rental housing in Mohave County is slightly newer than the State (26 years for Mohave County vs. 37 years for the State).

Exhibit 17: Dwelling Units by Year Built, Mohave County

Subsidized and Income-Restricted Units

Assisted housing, with income restrictions, is one of the most important types of housing required to ensure that all housing needs are met. Without such units, it is difficult for many low-income households to avoid being cost-burdened. Among these units, it is, also, necessary to meet a range of household size requirements.

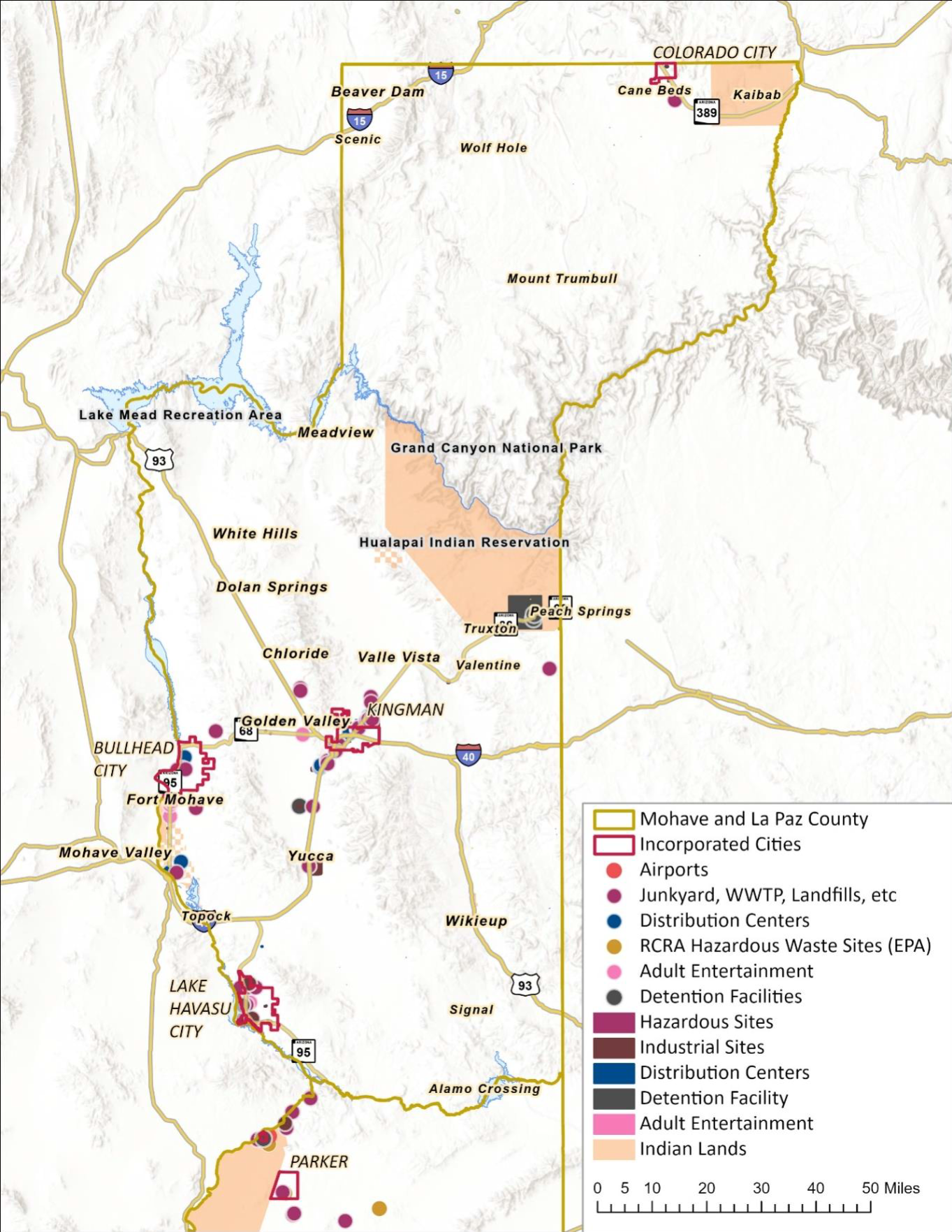

Within Mohave and La Paz counties, in 2022, there were 1,563 income-restricted subsidized housing units, among several locations (Exhibit 18).

Exhibit 18: Income Restricted Housing for Residents Earning Less Than 120% MFI, Mohave County

| Income Restricted Housing by Location |

Dwelling Units |

| Bullhead City |

699 |

| Kingman |

413 |

| Lake Havasu City |

378 |

| Mohave Valley |

44 |

| Parker |

29 |

| Total |

1,563 |

Source: NHPD & Policy Map

| Income Restricted Housing by # of Bedrooms |

Count |

| 1 |

809 |

| 2 |

445 |

| 3 |

309 |

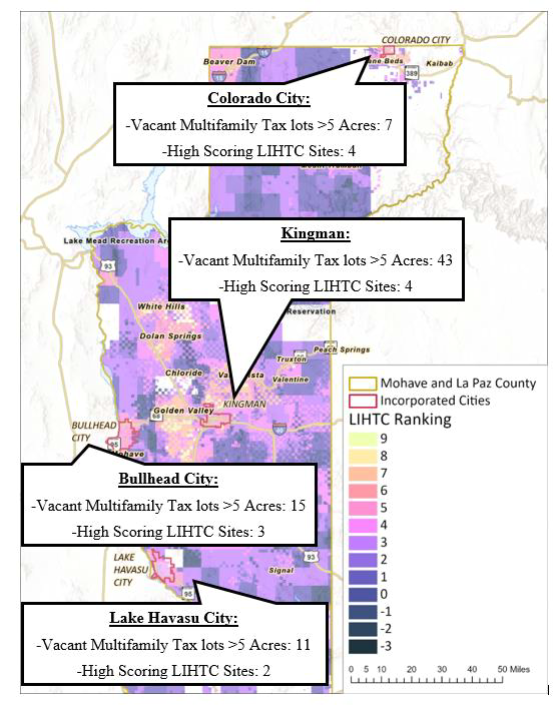

Income-restricted affordable housing in Mohave County has, traditionally, been constructed primarily through the use of Low Income Housing Tax Credits (LIHTC). There are currently 1,075 LIHTC units in Mohave County (Exhibit 19).

Exhibit 19: LIHTC Dwelling Units, Mohave County, 2023

| Year |

Project Name |

City |

LI Units |

| 1992 |

Copper Ridge Apartments |

Kingman |

31 |

| 1993 |

Vista Loma Apartments |

Bullhead City |

41 |

| 1994 |

Marble Canyon Manor |

Bullhead City |

132 |

| 1994 |

Glenridge Apartments |

Bullhead City |

52 |

| 2001 |

Somerset Village |

Kingman |

72 |

| 2006 |

Katherine Heights Villas |

Bullhead City |

56 |

| 2006 |

Katherine Heights Townhomes |

Bullhead City |

54 |

| 2006 |

Tivoli Heights Village |

Kingman |

48 |

| 2006 |

Aha Macav Housing I |

Mohave Valley |

44 |

| 2006 |

Becket House Apartments |

Lake Havasu City |

100 |

| 2007 |

Katherine Heights Townhomes II |

Bullhead City |

54 |

| 2007 |

Tivoli Heights Village Phase II |

Kingman |

48 |

| 2008 |

Katherine Heights Townhomes III |

Bullhead City |

37 |

| 2008 |

Chaparral Apartments |

Kingman |

20 |

| 2008 |

Cimarron Apartments |

Kingman |

40 |

| 2011 |

Lakeview Villas fka Casa Del Lago |

Lake Havasu City |

84 |

| 2015 |

Briarwood Apartments |

Lake Havasu |

56 |

| 2015 |

Kingman Heights Apartments |

Kingman |

57 |

| 2019 |

Kingman Veteran Villas |

Kingman |

49 |

| Total Units |

|

|

1,075 |

Source: Arizona Department of Housing and Mohave County, May 2023.

Housing Values and Rents

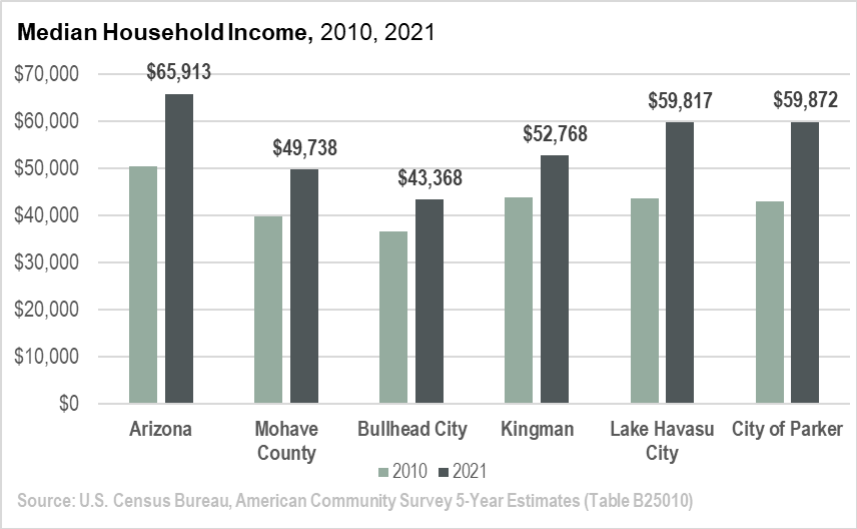

Home values in Mohave County have increased significantly in recent years. As indicated in Exhibit 20, median home price indices in the cities of Mohave County have increased between 17%-21.3% over the last two years.

As of May 2023, there were 634 housing units actively listed for sale in Mohave County, of which only three (3) units were priced below $172,000. Hence only 0.5% of the listed homes would be considered attainable to households earning 80% of the area median income.

| City |

2020 |

2021 |

2022 |

Annual Change % |

| Bullhead City |

$231,171 |

$294,085 |

$317,540 |

17.2% |

| Kingman |

$191,805 |

$247,281 |

$271,093 |

18.9% |

| Lake Havasu City |

$335,465 |

$444,214 |

$493,819 |

21.3% |

| Parker |

$277,298 |

$344,207 |

$405,314 |

20.9% |

Source: Zillow.com; analysis by FCS 5/19/23

Currently, the HUD fair market rents within Mohave County range from $711, for an efficiency unit, to $1,651, for a four-bedroom unit, as shown below.

Fair Market Rents, Mohave County, 2023

| $711 |

$831 |

$1,058 |

$1,473 |

$1,651 |

| Efficiency |

One-Bedroom |

Two-Bedroom |

Three-Bedroom |

Four-Bedroom |

Housing Gap Analysis

An analysis of rental housing demand and supply indicates that there are existing market gaps yet to be addressed by housing builders or developers. The most significant market gaps are contained within the upper- and lower-end of the market. For example, with 8,189 existing rental households in Mohave County earning $50,000+ annual income, the number of available rental units at attainable price levels included only 3,488 units. Hence, there is estimated pent-up demand for, approximately, 4,701 quality market-rate rental units with rents upwards of $1,250 per month (one-bedroom units) and $1,875 or more (for two+ bedrooms).

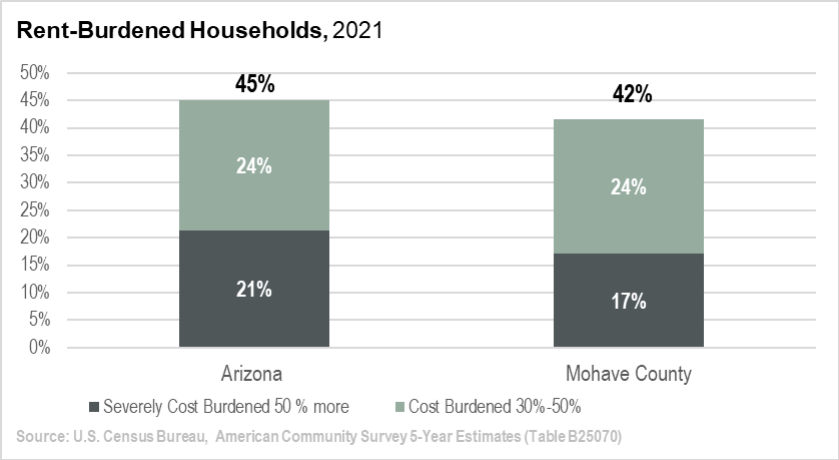

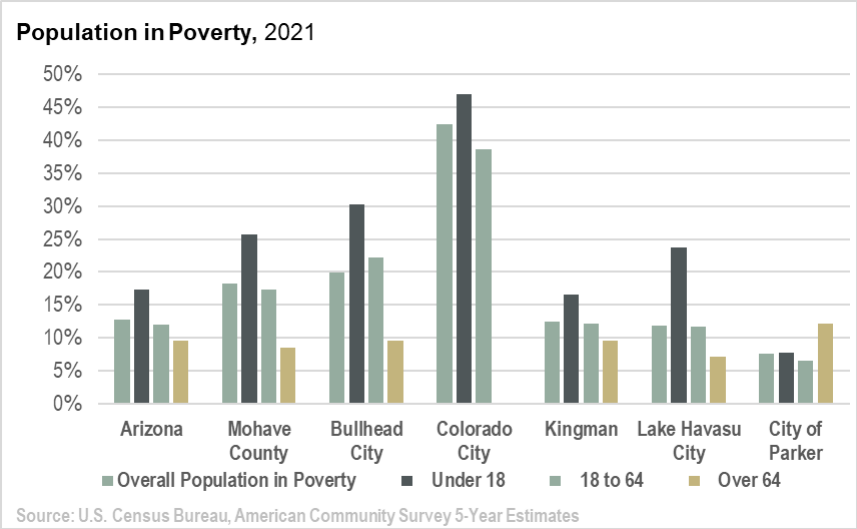

In addition to the current housing gap for market rate apartments, there is, also, significant demand for additional lower-cost rental units priced at $500, or less, per month. As indicated in Exhibit 21, there are, approximately, 8,040 rental households in Mohave County with incomes below $20,000, but only 4,531 rental units priced under $500 per month. This creates a market gap of 3,509 low- income rental units with an allocation of: 60% studio/one bedroom; 30% two bedroom; and 10% three-bedroom units. As a result of the inadequate supply of rental housing, many low-income households are paying well over 50% of their income on inadequate rental housing.

These gaps in the existing rental inventory result in a shortage of housing in the upper and lower rental unit categories. As a result, mid-level rental housing stock is a heavily competitive portion of the rental housing market that is addressing demand from lower- and middle- and upper income households to achieve market equilibrium.

As such, there is a current “pent up demand” for rental units needed at the upper- and lower-income affordability levels. As shown in Exhibit 20, it is estimated that the current near-term market demand for rental units includes 4,700+ market rate units (rents at $1,250 or above) and 3,500+ affordable units (rents at $500 or below).

Exhibit 21: Current Rental Housing Market Gap, Mohave County

| Median Household Income Range |

Affordable Monthly Rent Cost* |

Renter-Occupied Households |

Existing Rental Inventory |

Housing (Gap) or Surplus |

Pent Up Demand |

$75,000 or more

$50,000 to $74,999 |

$1,875

$1,250-$1,875 |

3,742

4,447 |

1,037

2,451 |

(2,705)

(1,996) |

(4,701) market rate gap |

$35,000 to $49,999

$20,000 to $34,999 |

$875-$1,250

$500-$875 |

4,638

5,530 |

8,650

9,728 |

4,012

4,198 |

↓

↑ |

Less than $20,000

Zero or Negative Income |

Less than $500

Requires subsidy |

4,947

3,093 |

1,770

2,761 |

(3,177)

(332) |

(3,509) subsidized housing gap |

| Total |

|

26,397 |

26,397 |

|

(8,210) |

Source: U.S. Census Bureau, American Community Survey S25103 & B25063; FCS Group.

*Calculated as 30% of income range based on HUD guidelines

Population Growth Forecast

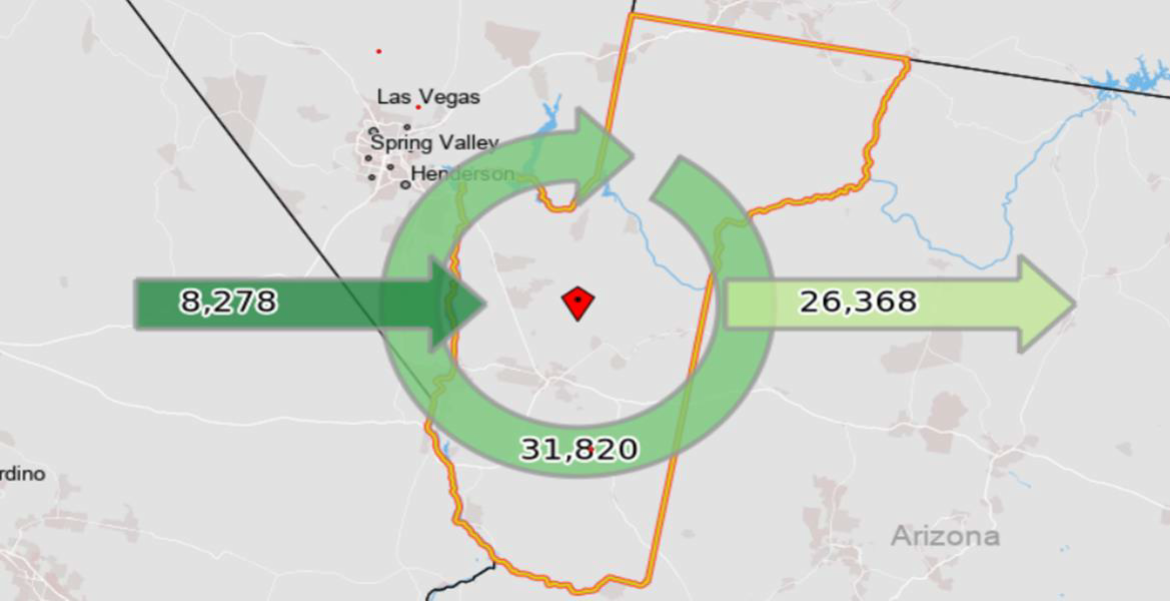

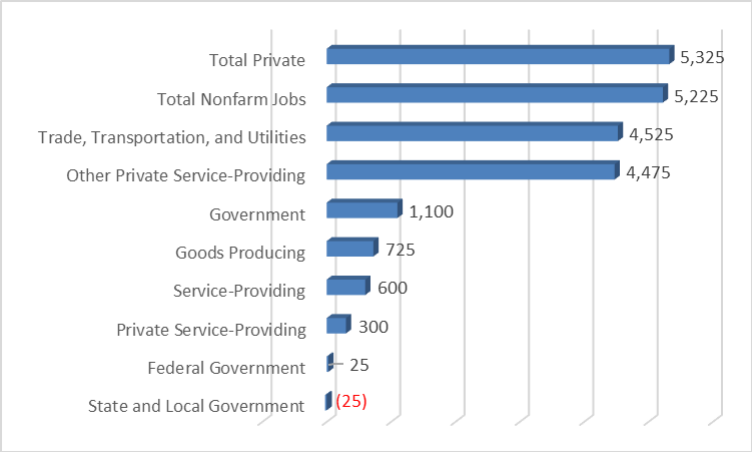

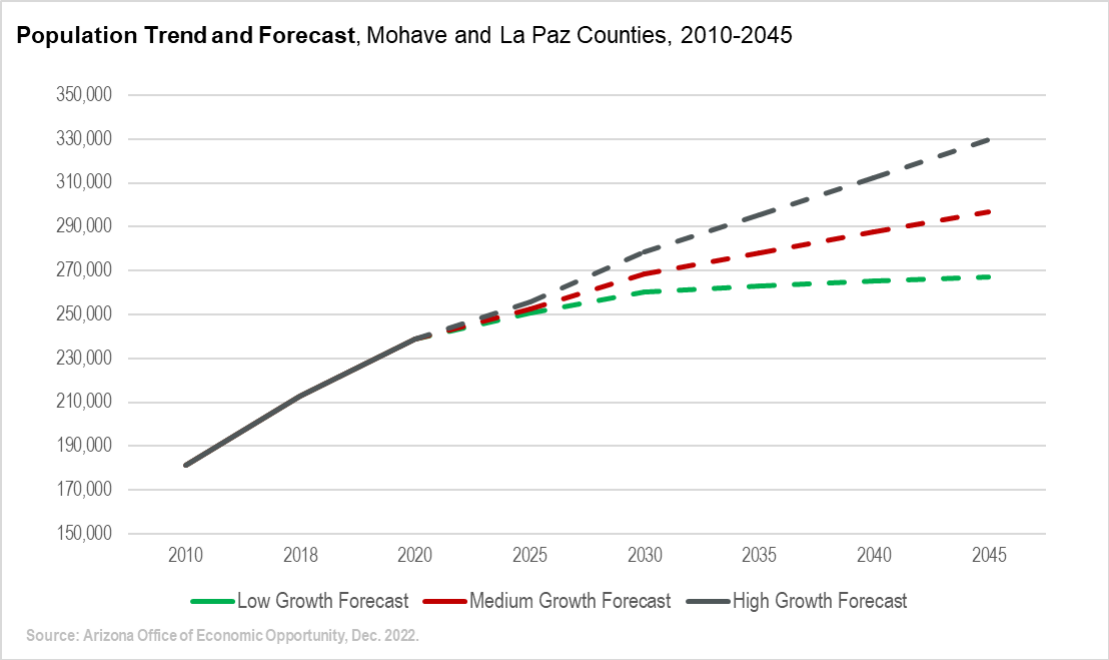

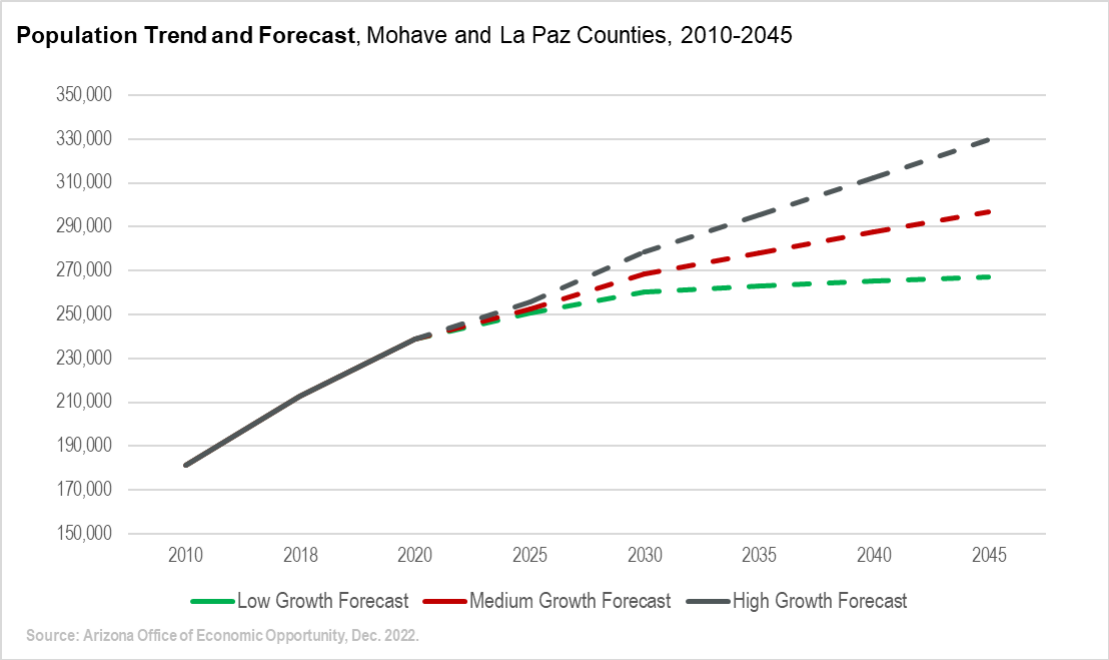

Arizona continues to be among the fastest growing states in the U.S. According to the Arizona Commerce Authority, Office of Economic Opportunity, the statewide population is projected to increase from 7,409,200 to between 8,855,300 and 10,393,300 people by year 2045. The low, medium, and high population growth forecasts, provided by the Arizona Office of Economic Opportunity, indicate that Mohave and La Paz Counties, in aggregate, can expect to add between 29,335 and 91,535 residents between 2022 and 2045. This equates to an annual average growth rate (AGR) of between 0.5% and 1.4%.

Stakeholder Advisory Committee input indicated that the County will, likely, grow faster than the low and medium forecasts, but not as fast as the high forecast. In light of the direction from the Advisory Committee, a medium-high forecast has been assumed for projecting housing needs, into the future, which is based on the mid-point of the State’s medium and high growth rates (equates to 1.19% annual average rate of growth). It should be noted that a future population growth rate of 1.19% is well below the historical average rate of growth that has occurred in the local area over the past 22+ years.

The resulting medium-high growth forecast for Mohave and La Paz Counties (75,085 residents added by 2045) is utilized for this housing needs assessment (see Exhibit 22).

Exhibit 22: Mohave County Population Trend and Forecast (2010-2045)

Housing Need Forecast

The baseline housing demand forecast considers net new housing needed to meet additional population growth and the mix of housing types that would, most likely, address future market requirements. The housing needs take into account the following factors:

- Immediate need for 8,200+ rentals or subsidized housing units to accommodate current pent-up demand as discussed in Exhibit 21

- Medium-high population growth forecast assumes 75,000+ net new residents added over the next 20 years throughout the study area

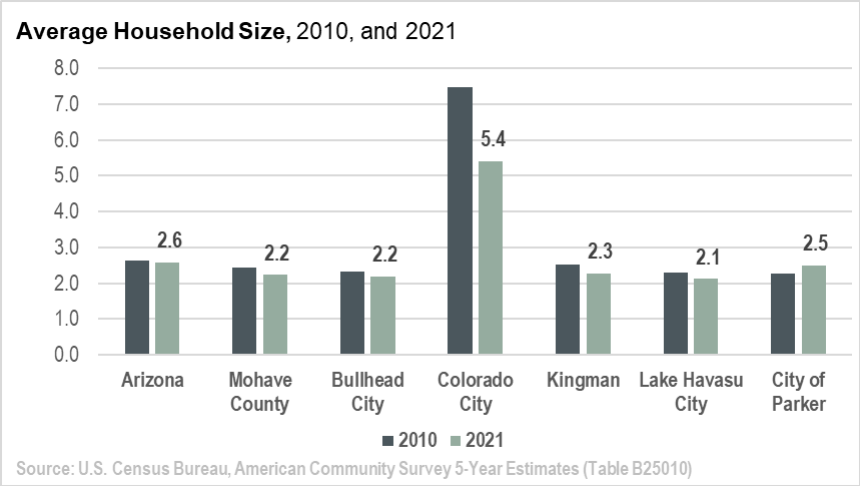

- Average household size (2.24 people per occupied dwelling)

- The share of all housing that is owned by part-time residents or investors is expected to increase from 19.3% (2022 est.) to 20% by year 2045

- Potential for development of additional government-subsidized housing

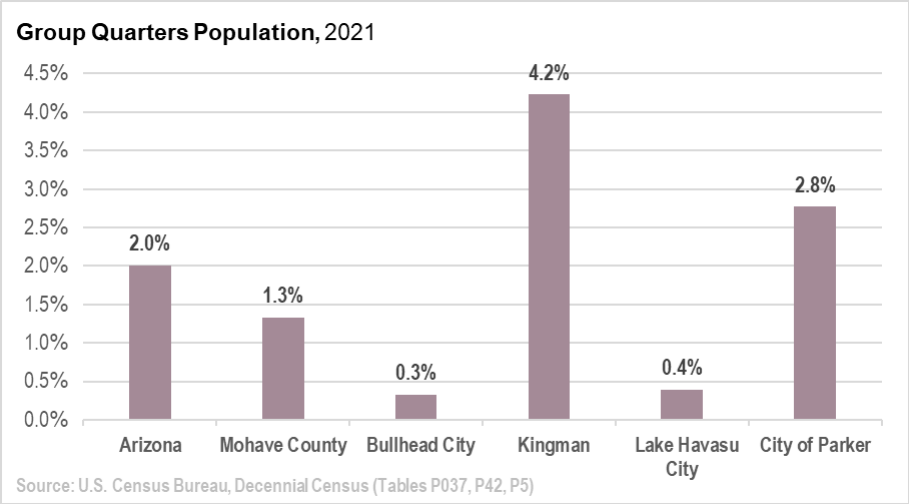

- Consistent allocation of population that resides in group quarters arrangements (1.3%)

- Adequate infrastructure (water, sewer and road capacity) is available to accommodate future development or single-family subdivisions within cities and in unincorporated communities

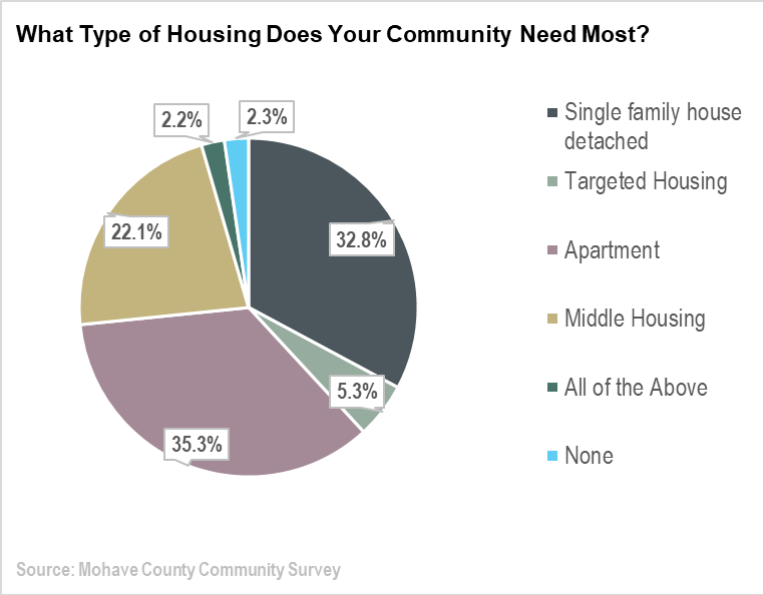

The baseline forecast reflects a range in housing types to address market preferences and demand for more attainably priced “middle housing” types, such as apartments, plexes, manufactured homes and accessory dwellings.

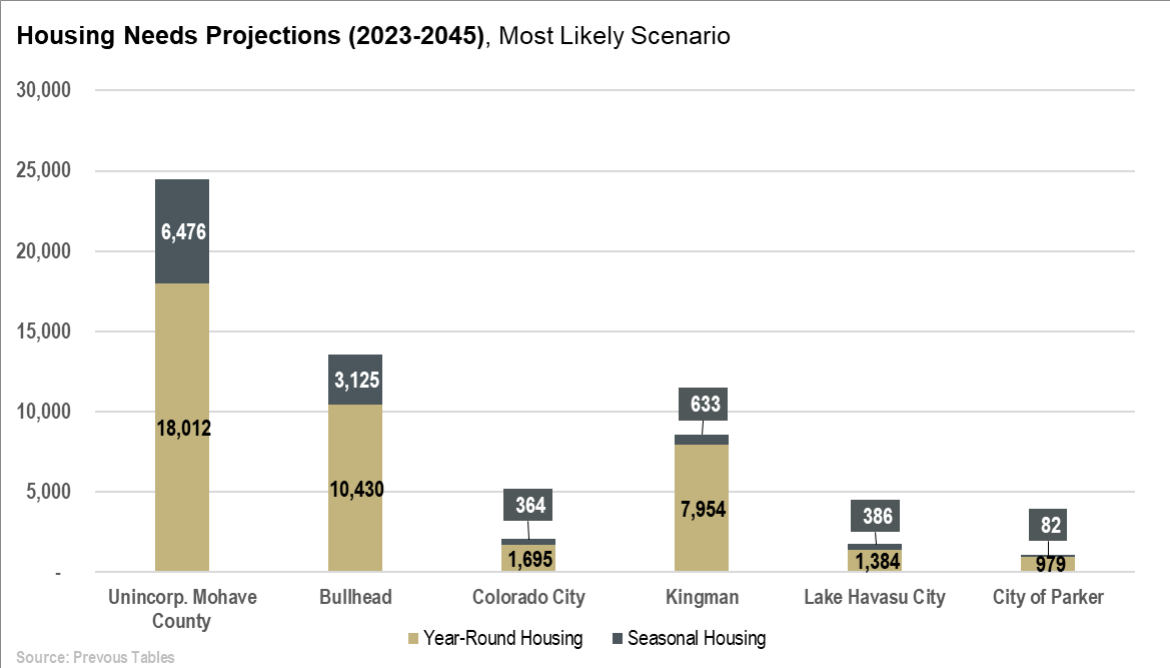

As indicated in Exhibit 23, the baseline population growth forecast requires, approximately, 50,675 net new housing units within the study area over the next 20-25 years. This includes:

- 33,065 housing units for permanent year-round residents based on population growth

- 9,400 seasonal housing units for part-time residents

- 8,210 apartment units to address short-term market supply gaps

- Shared housing for 1,018 people living in group quarters arrangements, such as assisted living, congregate care, transitional housing, and emergency housing.

Exhibit 23: Net New Housing Needs by Type: 2022-2045

| Mohave County Housing Needs: 2022 to 2045 |

| Likely Growth Scenario* |

2022 Est. |

2045 Proj. |

Proj. Change |

| Mohave County Population |

237,965 |

313,050 |

75,085 |

| Less Group Quarters (1.6%) |

3,228 |

4,246 |

1,018 |

| Pop in Households |

234,737 |

308,804 |

74,067 |

| Avg. Household Size |

2.24 |

2.24 |

|

| Households (year round) |

104,793 |

137,859 |

33,065 |

| Vacancy and Seasonal Housing (%) |

19.3% |

20.0% |

|

| Vacancy and Seasonal Housing (units) |

25,065 |

34,465 |

9,400 |

| Baseline Housing Demand |

129,858 |

172,324 |

42,465 |

| Pent-Up Rental Demand |

- |

- |

8,210 |

| Total Housing Demand (dwelling units) |

- |

- |

50,675 |

| Plus Group Quarters Pop. |

|

|

1,018 |

| Proj. Group Quarters Housing (rooms)** |

|

|

679 |

** based on midpoint of middle and high growth forecast from AZ Office of Economic Opportunity.

** assumes 1.5 people per room.

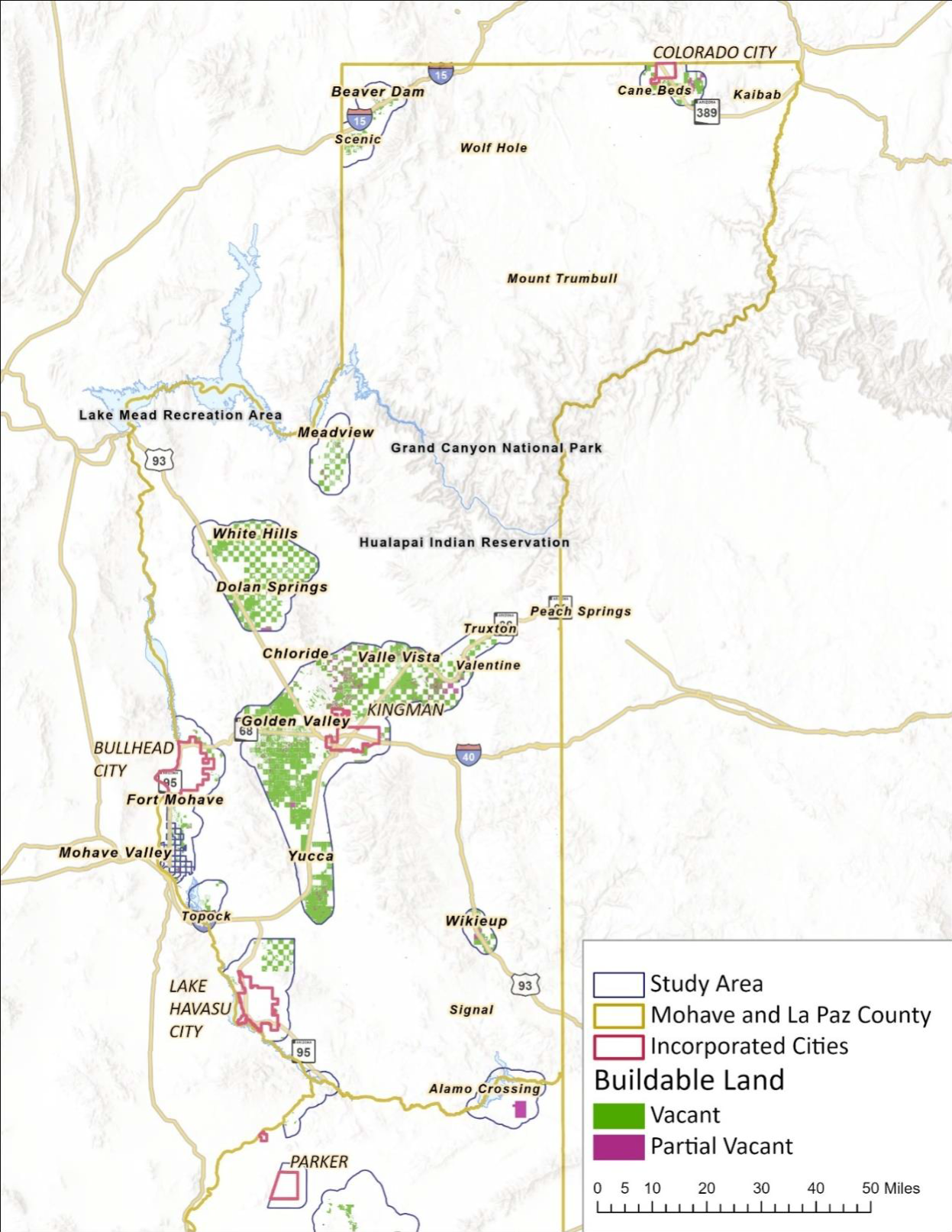

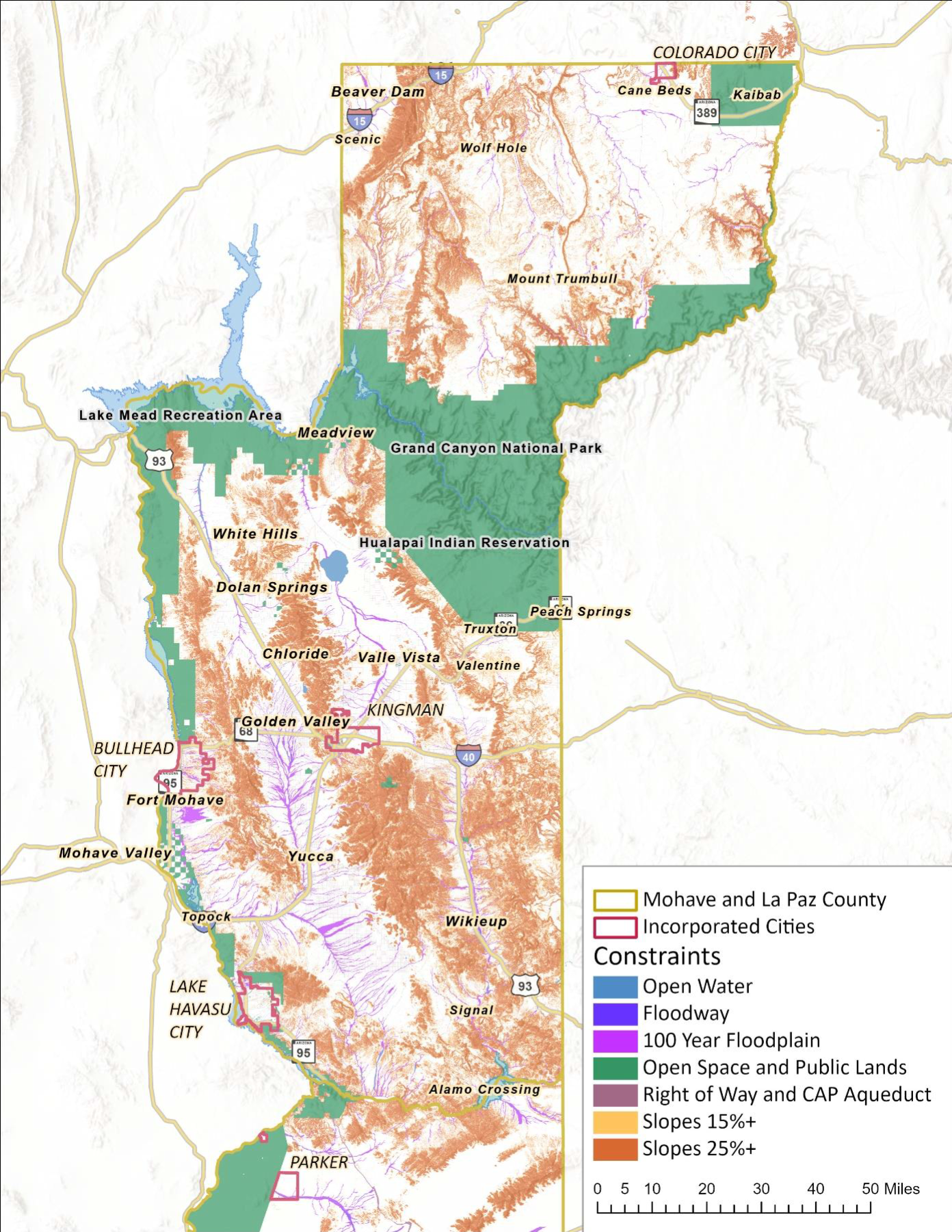

Projected Housing Demand by Housing Type and Location

Exhibit 24 identifies the types of housing products that are most consistent with the projected housing needs for Mohave County by household income levels. The potential allocation of housing demand takes into account current trends, data, and infrastructure capacity, as well as buildable land opportunities, as identified herein.

Exhibit 24: Projected Net New Housing Needs by Type and Location: 2022-2045

| |

Unincorp. Study Area |

Bullhead |

Colorado City |

Kingman |

Lake Havasu City |

City of Parker & Parker Strip |

Total |

| Single Family Detached |

13,176 |

7,320 |

1,464 |

5,856 |

878 |

586 |

29,280 |

| Townhomes / Plexes |

658 |

1,645 |

247 |

1,028 |

411 |

123 |

4,112 |

| Multifamily (5+ units) |

287 |

1,638 |

205 |

1,228 |

655 |

82 |

4,095 |

| Mobile home / other |

9,232 |

3,033 |

132 |

528 |

- |

264 |

13,188 |

| Total Dwelling Units |

23,352 |

13,636 |

2,047 |

8,640 |

1,945 |

1,055 |

50,675 |

| Potential Demand by Location |

46% |

27% |

4% |

17% |

4% |

2% |

100% |

| Seasonal Housing Demand |

5,338 |

2,576 |

300 |

522 |

318 |

68 |

9,122 |

| Permanent Housing Demand |

18,015 |

11,060 |

1,747 |

8,118 |

1,627 |

987 |

41,554 |

* Likely Growth Scenario based on midpoint of medium and high growth population forecast. Table does not reflect group quarters units/rooms.