Bad Check Program Information

Each day thousands of checks are written to pay for goods and services. Hundreds of checks are not honored when presented to the bank. Hard working merchants and others go unpaid, who become the victims of bad check crimes.

Arizona has become the #1 State in the United States for ID Theft for the second year in a row (2004 and 2005). This is not something we are proud of. State Law is the primary enforcement tool for businesses and individual victims. Criminal provisions are designed to protect the innocent bad check victims and these laws mandate recovery of restitution against bad check writers.

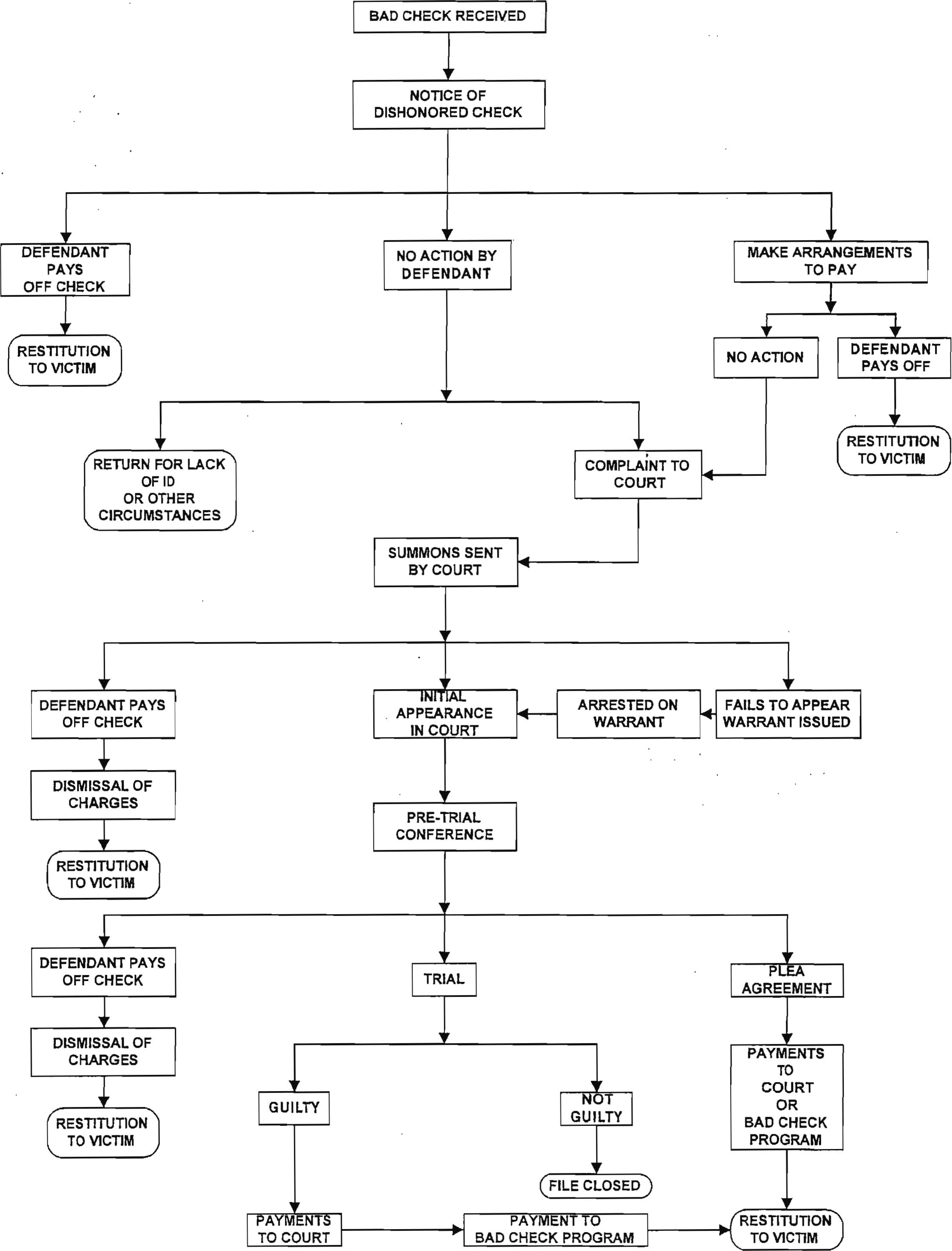

The law makes "Issuing a Bad Check” a Class 1 Misdemeanor, with repeated violations and high dollar amounts resulting in Felony prosecution. When a check is returned unpaid, you (the victim/merchant) need to notify the bad check writer in writing that the check was returned for non-payment. THIS IS ACCORDING TO ARIZONA LAW. The check writer must reimburse you for the total amount of the check within time limits established by law. Thereafter, the check writer may be subject to criminal prosecution by the Mohave County Attorney’s Office.

The Mohave County Attorney’s Office established the Bad Check Program to assist victims/merchants. The primary responsibility of the program is to recover restitution monies for you. Most “first time” bad check writers will be provided an opportunity to avoid prosecution by payment of full restitution and statutory fees which is referred to as the “diversion” process. If the check writer does not make full restitution, and if sufficient evidence for criminal charges is available, criminal prosecution will be initiated.

This Handbook provides valuable information on reducing and eliminating losses due to bad checks. The Mohave County Attorney’s Office created specific procedures for victims/merchants accepting checks to follow, minimizing exposure to bad checks and providing evidence against the check writer. This guidebook provides directions for processing bad checks and supporting the prosecution of bad check writers. Please read this guidebook carefully and follow the instructions.

In addition to this handbook, the Bad Check Program Coordinator is available to provide free training to victims/merchants on check acceptance procedures and forgery detection. Training of your employees should assist in reducing the high costs of bad check writers. With the proper trained employees, this is your first step in fighting the bad check writers. The training only works when the managers/owners support the Bad Check Program process.

The Mohave County Attorney’s Office Bad Check Program is mandated to work with victims/merchants in identifying bad check crimes and quickly enforcing full restitution for victims of these crimes. Together, significant reductions in bad checks can be achieved.

Each day thousands of checks are written to pay for goods and services. Hundreds of checks are not honored when presented to the bank. Hard working merchants and others go unpaid, who become the victims of bad check crimes.

Arizona has become the #1 State in the United States for 10 Theft for the second year in a row (2004 and 2005). This is not something we are proud of. State Law is the primary enforcement tool for businesses and individual victims. Criminal provisions are designed to protect the innocent bad check victims and these laws mandate recovery of restitution against bad check writers.

The law makes "Issuing a Bad Check" a Class 1 Misdemeanor, with repeated violations and high dollar amounts resulting in Felony prosecution. When a check is returned unpaid, you (the victim/merchant) need to notify the bad check writer in writing that the check was returned for non-payment. THIS IS ACCORDING TO ARIZONA LAW. The check writer must reimburse you for the total amount of the check within time limits established by law. Thereafter, the check writer may be subject to criminal prosecution by the Mohave County Attorney's Office.

The Mohave County Attorney's Office established the Bad Check Program to assist victims/merchants. The primary responsibility of the program is to recover restitution monies for you. Most "first time" bad check writers will be provided an opportunity to avoid prosecution by payment of full restitution and statutory fees which is referred to as the "diversion" process. If the check writer does not make full restitution, and if sufficient evidence for criminal charges is available, criminal prosecution will be initiated.

This Handbook provides valuable information on reducing and eliminating losses due to bad checks. The Mohave County Attorney's Office created specific procedures for victims/merchants accepting checks to follow, minimizing exposure to bad checks and providing evidence against the check writer. This guidebook provides directions for processing bad checks and supporting the prosecution of bad check writers. Please read this guidebook carefully and follow the instructions.

In addition to this handbook, the Bad Check Program Coordinator is available to provide free training to victims/merchants on check acceptance procedures and forgery detection. Training of your employees should assist in reducing the high costs of bad check writers. With the proper trained employees, this is your first step in fighting the bad check writers. The training only works when the managers/owners support the Bad Check Program process.

The Mohave County Attorney's Office Bad Check Program is mandated to work with victims/merchants in identifying bad check crimes and quickly enforcing full restitution for victims of these crimes. Together, significant reductions in bad checks can be achieved.